“I need a short-term small business loan; do I need a good credit score? - A customer

When your business grows, you need additional funds to meet the expansion demands. It is where you need business finance loans. There are many things you should know to ensure that there are minimal issues later on.

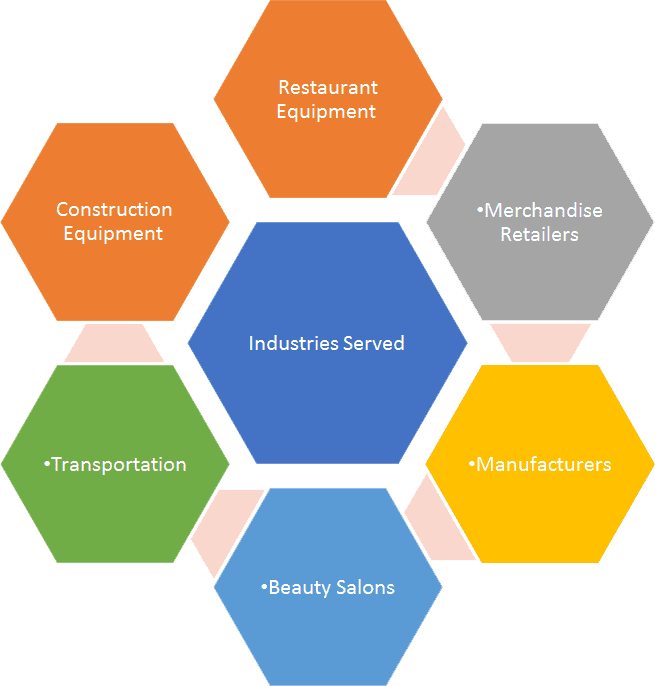

Source: WPSFI

Things To Do Before Applying For a Small Business Loan

Even before you start to glance through the eligibility requirement of a loan, you should:

1. Get a Business Bank Account

If you don’t have it, you need to get it first and wait a minimum of 6 months before applying. As a lender, we’ll need a business bank account statement for review. It should reflect the gross sales your business is doing to show the health of your business. You should not make an application without it, as many applications get rejected for this reason alone.

2. Find Your Credit Score

Once you have been in business sufficiently long, you need to know your credit score. However, we consider all credit types, whether excellent or poor. You may be wondering how your credit score is helpful. Your credit score shows your financial health and habits when it comes to paying off loans.

If you have taken a loan in the past and have repaid it timely, then it will affect your credit score positively. What if you have not paid back your previous loan consistently? Can you expect your credit score to be the same? No. In such cases, your credit score will get affected negatively. A lower credit score impacts your creditworthiness. When you apply for a loan in the future, the loan amount sanctioned may be lower than what you have applied for. Or you may have to pay a higher rate of interest.

3. Check the Loan Eligibility

Before applying, it is always better to check your loan eligibility. There are many factors that come into play in loan approval. Here are the key ones:

- Loan Size: It is the amount of loan for which you are making the application. It should be between USD 10,000 to USD 500,000.

- Loan Period: Also called loan term, it is the maximum duration you will have to repay the loan. For us, the loan term is 36 months. It means that you will have to repay the loan within 3 years or within your chosen term.

- Years in Business: You need to be in the business for a minimum of 6 months.

- Monthly Sales: The sales generated should reflect in the business bank account.

- Credit Score: We accept all credit scores

- Repayment Mode: The fixed monthly payments with simple, easy auto repayment from your business bank account.

4. Keep Documents Handy

There are certain documents that are needed for loan approval. These are:

- Business account bank statement for the stipulated time

- Credit Report

- ID-related documents

You must keep these documents handy to avoid hunting them for the last moment.

6. Make a Pre-Approval Application

Once you have checked your eligibility, you should get your pre-approval for FREE. You can make the pre-approval application here. All you have to do is to choose:

- Amount Requested

- Monthly Gross Sales

- Years in Business

7. Wait For a Response

Once you have applied for pre-approval, you will usually get the response within 4 to 6 business hours. The funds are transferred into your business bank account if the application is approved.

Once you get the loan, you may receive the repayment schedule. It contains the repayment details, like the monthly amount and the date. There are many things you should avoid doing after getting the loan:

Things Not To Do Before Applying For a Small Business Loan

When applying for a small business loan, it's important to understand that certain actions could potentially harm your chances of approval. There are a few key things you should avoid doing before submitting your loan application.

1. Don’t Be Delinquent on Payments

It raises a red flag when you don’t make timely payments when they are due. You may have to pay a late fee or additional interest, or it may affect your credit score negatively. If you stop making the payment, you may hear calls from us.

2. Don’t Repay Quickly

If you repay the loan too fast, it will defeat the very purpose of going for the loan. You may end up becoming short of available funds to grow your business. If you decide to repay, consider your savings before deciding on it.

3. Don’t Focus Only on Interest Rates

It is short-term thinking to focus only on the interest rates. You should focus on other important criteria, such as loan terms and the flexibility of repayment as well.

By avoiding these common mistakes, you can improve your chances of securing a small business loan to help your business thrive.

Why Should You Go for a Loan with Us?

A commercial business finance loan from AdvancePoint Capital comes with flexible repayment terms. We don’t put your business at risk as loans from us are unsecured, so you don’t need to provide security for a loan!

Call us now for a Free Quote!