Small Business Financing Options

Small business owners searching for information related to small business loans must ask themselves first which business loan options are best for their business investment. Is it a term loan? A line of credit? Financing for quick access to cash?

The search for small business funding is not the same as looking for consumer loans. The purpose of what you are using the money for your business can dictate what business loan products you will choose. Similarly, the loans or small business funding you need for business renovations might not be the same one you’d get if you were experiencing a short-term cash flow problem or needing a working capital loan for managing cash flow.

Where do companies get the necessary information to make solid financing decisions when it comes to small business loans?

While traditional brick-and-mortar banks are often difficult for the average small business owner to get approved for loans, you still have many other financing loan options in the marketplace.

AdvancePoint Capital has a lender network full of a variety of business funding options for business owners, including SBA loans, business lines of credit, business term loans, and other options as well. We have competitive rates and terms, have a variety of business funding options, and can help you choose the right small business loans for your business to access. Let AdvancePoint Capital help you choose the right loan for your business!

Get Started Today

AdvancePoint Capital makes the loan application process a simple, straightforward experience.

Small Business Financing Options

Small Business Term Loan

A business loan is considered a "term" loan with a lump sum offer at a fixed term from 6 to 36 months, with set weekly, bi-weekly, or monthly payments. Loan funds can be used for almost any business purpose such as working capital, equipment financing, and other business expenses.

Business Line of Credit

A business line of credit is a revolving credit line that works like a credit card in that you can draw money as needed, and only pay interest on the outstanding balance. With a line of credit, you can draw up and draw down funds. The revolving credit can typically be accessed using an online portal or mobile app. A line of credit has competitive interest rates.

SBA Business Loans

The U.S. Small Business Administration (SBA) offers loan programs to small businesses looking to grow or expand their businesses. Small Business Administration is dedicated to small businesses and provides capital through the SBA loan program by approved SBA lenders. Maximum loan amounts depend on the SBA loan program.

Equipment Financing

Equipment financing can be in the form of a loan or lease used to purchase business-related equipment. The equipment is used as collateral for the lease or loan. Equipment loans include interest and principal over a fixed term. Equipment leases can be an alternative to equipment loans. You need a good credit score for approval.

Merchant Cash Advance

Merchant cash advances (MCA's) are a purchase of future sales receivables agreements that are structured as a lump sum payment to a business in exchange for an agreed-upon percentage of future sales deposits or credit card and/or debit card sales. The repayment term is flexible to future sales but typically is predicably set to be repaid within 18 months or less.

Invoice Financing

Invoice financing, also known as invoice factoring, is a way for small businesses to borrow money against the amounts due from customers' unpaid invoices. Invoice factoring is a purchase of an invoice from the issuer to the invoice finance company at a discount. Invoice financing accelerates the receivables of a business to improve its cash position. This elevates the problem of the issuer waiting to get paid on invoices. If you need immediate cash this is a great option.

Business Cash Advance

A business cash advance is a revenue-based business financing option commonly offered to businesses that don't qualify for traditional financing. A business cash advance advances money that is repaid out of future sales. Keep in mind that a business cash advance is not a loan, but a purchase of future receivables at a discount for funds today. Payments are made by an ACH "convenience" payment either daily or weekly. The payment is based on a set percentage of your monthly revenue.

Short-Term Business Loans

Commonly known as online term loans, short-term loans are an alternative to traditional business loans. Online small business lenders specialize in these loans for small businesses that have difficulty with credit or other factors. Some call this product bad credit business loans.

The Fast, Convenient, And Straightforward Way To Get The Financing Solution You Need For Your Business – Now!

Identify Why You Need Small Business Loans

The first step in any search process for the right financial products is clearly defining why your small business needs the funds. The “why” will direct you many times to the right loans. The most popular reason why businesses look for financing is working capital. For most businesses, there will be periods of fluctuation in revenue that can cause some cash flow problems. Let's look at the most common uses of business funding.

Working Capital Loans-Unexpected Expenses

Working capital covers a lot of different uses, but simply put, is additional money to cover the everyday needs of a business.

Business Needs

A new venture that requires a down payment, upfront capital, recruiting key employees, initiating a new business relationship, or research and development for growing businesses and their business needs.

Purchasing Inventory

A common need for eCommerce, manufacturers, and other retailers dictates how a business operates.

Marketing/Advertising

Small business owners need funds to promote their businesses. A variety of advertising strategies include internet marketing, direct mail, radio advertising, flyers, and paper ads, to name a few.

Purchasing Equipment

Most businesses have some type of equipment that is essential to the way the business operates. Perhaps you’re a business that requires machinery, furniture, medical equipment, construction equipment, computers, or tools. These are common requests from restaurants, auto repair shops, construction industries, medical practices, and manufacturers.

Infrastructure Improvements/Business

Expansion

This category could include a move to a more prominent location or office that requires a business expansion loan due to the size of capital required.

Information Technology and Software

In today’s world, capital may be needed for business needs related to website development and site maintenance, customer relations management software, computers, machines, and other products essential for a business’s success.

Consolidate Debt

When debt payments can be overwhelming debt consolidation loans can be a great solution to improve cash flow.

How Do I Qualify For a Small Business Loan?

There are a few factors involved in your approval.

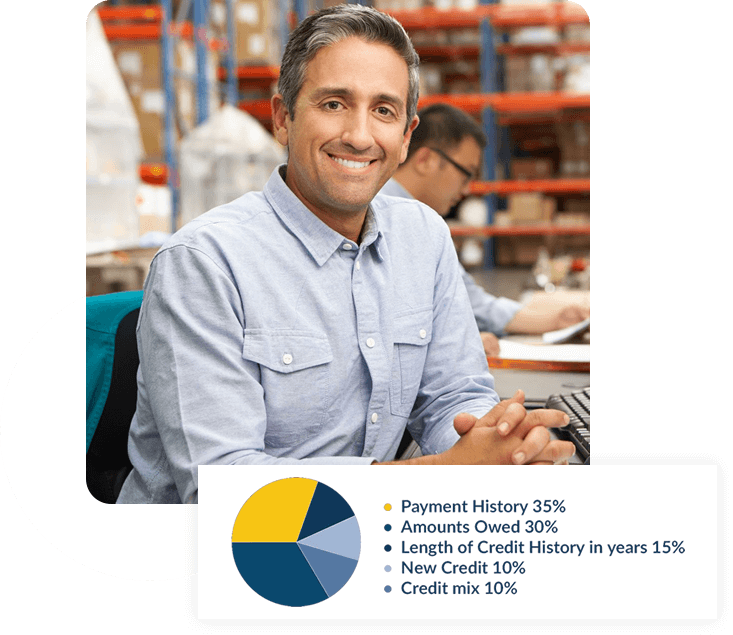

Creditworthiness: Credit Score

How do your personal credit, credit score, and credit report affect qualifying for small business loans?

Good Personal credit of the business owner plays a significant role in determining what, if any, loans small businesses can be approved for by lender loan applications. As a business owner, the better your personal credit is, the more funding options you will have to choose from and the easier it will be to qualify. However, it’s essential to know that not all financing offers involve a personal credit check and the credit score isn't everything.

How to Understand, Review, and Analyze your Credit Score

A smart thing to do is pull your own credit information using all three credit bureaus to see your credit score for Equifax, Experian, and TransUnion. (Be wary of sites that offer you “a credit score” as that may be another credit risk model other than FICO). As a rule of thumb, a personal credit score of 750 FICO and up is Excellent, a credit score of 720 FICO and higher is good, a credit score of 680 FICO and higher is Fair, a credit score of 680 to 620 FICO is marginal, and below 620 credit score is considered poor. For the most part, the longer the term and the lower cost of small business loans will require a higher credit score and standards to qualify.

Length of Time in Business

How long you have been in business is a significant factor in determining qualifications and repayment guidelines for loan products. Let’s face it; business lending is a risky business. Business leaders need to see a track record to take a calculated risk in providing you with a term loan. Many businesses don’t make it past the first year in business, so obviously, business lenders will be cautious if you have less than two years in business when providing loans.

Financial Statements

What financial documents and information will business lenders need for small company loans?

Business Bank Statements

Almost all small loans will require a business checking account to review in order to qualify. Typically three months are needed, but sometimes 6 to 12 months may be necessary if the business is seasonal. Bank statements show business lenders how much revenue the business has, the cash flow activity of the company, and your ability, as the business owner, to manage the business’s finances.

Profit & Loss and Balance Statements

These statements provide a more detailed view of the business and its health and may be required for the longer-term and lower-cost term loan options. The good news is that Profit & Loss and Balance Sheet statements typically are not necessary for alternative business lending products.

Business and Personal Tax Return

Some business lenders will need to see tax returns. If that is going to be a challenge, there are a lot of alternative business online lenders who will not require these documents, but keep in mind, most likely, the term loan offers you receive will be impacted by the lack of documentation and therefore be reflected in the costs and repayment guidelines you will be provided.

How do Small Business Loans Work?

Interest Rate of Factor Cost of a Small business loan

Small business rates depend on the business financing product you are requesting and your qualifications. The qualifications that can dictate rates on small business loans include information on your business funding application credit, documentation, industry, time in business, resume, business plan, and experience.

There are two most common types of business loan rates out there when shopping for a loan. Some small business loans charge a rate as consumer lending, but others charge a “factor rate” or “factor cost,” which is a flat cost, not principal and interest.

Interest rates are charged based on the daily principle, whereas factor rates are flat costs.

This means business owners pay the same total cost whether they pay off early or not unless they offer an early pay discount or penalty. But rate or factor cost does not tell the whole story. Most lenders charge additional fees, so you have to count those in the overall cost when comparing.

Repayment Schedule of Small Business Loans

The length of the repayment term for loan products varies greatly and can be from 6 months to 7 years, depending on the product and qualifications. Although one loan may seem cheaper than another, you must factor in the length of time repayment.

You may want to consider a more affordable payment with longer-term versus short-term loans if you are willing to pay more in rate and/or cost for that benefit. If the options are loans, then check for the APR (Annual Percentage Rate), which factors not only rate and cost but also the length of repayment and payment frequency.

Installments and Method of Repayment of a small business loan

Disbursements can be monthly, biweekly, weekly, and even daily (weekdays), depending on the funding product. It is very common for collection to be in the form of an auto deduction from your bank account via an ACH. Although payment frequency can be a factor if you have very low average daily balances in your business bank account, the interest rates, costs, and term should be a more significant consideration than that payment frequency.

Origination Fees

This is a charge for services at the time of consummation of the loan. The fee is often a percentage of the amount borrowed or advanced, typically ranging from 0% to 5%.

What is The Difference Between Secured Loans and Unsecured Loans?

The main difference between secured loans and unsecured loans is that a secured loan requires collateral, not just business assets. On the other hand, an unsecured loan does not require collateral to back up the debt.

You can get a secured or unsecured personal loan from most lenders, including banks, credit unions, and online lenders. As long as you have a high score with the credit bureaus and have made wise financial decisions in the past, you should be able to qualify with most loan providers.

When evaluating an application, a lender considers your history, previous debt payments, and current finances, including your savings account — this is true whether you’re applying for a secured or unsecured loan.

But with secured financing, you offer a personal asset, which you risk losing if you default on the loan. Collateral provided for a secured personal loan could include real estate, vehicles, or other valuables you own.

Here are other differences between secured and unsecured debt you should know about.

Amounts and Reasons for Borrowing Money

There are different reasons a borrower would apply for a secured and unsecured loan. Generally, secured loans are for larger amounts of money. Because they’re backed by an asset, you can borrow more money without paying a higher rate.

With unsecured loans, the charged interest rate is higher. So using an unsecured loan to borrow a lot of money could mean that you end up paying a much higher amount of interest like business credit cards. However, they’re quite common and you likely already have these types of loans as a consumer.

Credit card debt, student loans, and some personal loans are unsecured. You might take out an unsecured loan from a financial institution to cover unexpected business expenses or to access cash to solve a short-term issue.

Borrowers tend to choose secured personal loans for higher amounts of money. Common examples are mortgages or home equity loans. If you’re looking to purchase a car, the lender retains the title of the vehicle until you pay it off, so an auto loan is a type of secured debt as well.

Risk Levels

Secured and unsecured loans: what’s the difference in risk levels? A secured personal loan carries a higher risk because of the collateral. If you default on a secured loan, you could lose your collateral. The default will also show up on your credit report.

Unsecured personal loans are different. If you default on them, it will affect your credit score, but you won’t lose other assets. As such, they are considered to have less risk for the borrower.

Interest Rates

Although secured loans are riskier for you, lenders have more confidence in them. They come with collateral backing so a bank will offer lower interest rates and lower average APR.

On the other hand, a bank, credit union, or online lender can take your collateral if you cannot make your monthly payments — that’s why they don’t have to take on as much risk.

Unsecured loans work differently. They have higher interest rates because the bank will lose money if you cannot pay your monthly installments.

Repayment Terms

When assessing secured vs. unsecured loans, you should consider the repayment term. Because a secured loan amount is larger and has a lower interest rate, it might have a longer repayment time. You might repay your loan over five, 10, or even 30 years.

With an unsecured personal loan, you generally would take out a smaller amount and pay it back in less time. Because it’s riskier for the lender, unsecured loans don’t usually have long repayment times.

You Can Get a Secured Loan with Lower Personal Credit Scores

If you want to borrow money, you also have to consider whether you have bad credit or excellent credit. With a poor credit history, you’ll have an easier time getting a secured loan with personal assets. That’s because the collateral helps to offset the risk the lender takes on when lending to someone with poor credit.

Either way, plan to save money and prioritize repaying your debt on time — whether it’s a secured loan or unsecured. This will improve your credit score and you’ll have an easier time qualifying for the financial products you need in the future.

Are Small Business Loans Secured or Unsecured?

Small business loans can be either secured or unsecured, depending on the lender and the specific terms and conditions in the agreement. Secured loans use business collateral and/or personal collateral as security. On the other hand, unsecured loans do not require collateral but rely more heavily on the borrower's creditworthiness and financial history.

What is the Easiest Small Business Loan To Get?

The easiest small business loan to get will vary depending on various factors, including your qualifications and whether you want to pay more for ease of approval and speed to funding. Additionally, certain online lenders and alternative financing options may have less stringent eligibility criteria than traditional banks, but products may have less favorable rates and terms. It is important to balance what product is easily approved for and the costs and terms you will be offered. Research and compare multiple lenders to find the best fit for your specific needs.

Get Started Today

AdvancePoint Capital makes the loan application process a simple, straightforward experience.