If you own a business, you're likely aware of the importance of a profit and loss statement. Profit and loss statements help you analyze how your business performs over a specific period, usually by quarter or accounting year. While understanding a profit and loss statement may seem challenging, becoming familiar with the creation process and common terminology will benefit your company's future.

What Are Profit and Loss Statements?

These financial statements are also called income statements or P&L statements. But what is the profit and loss statement definition? Businesses worldwide use profit and loss statements to show revenue, expenses, and net income over a specific period, unlike a balance sheet definition focusing solely on a particular point in time. Every business is different, meaning a profit and loss statement will be created at a chosen time that suits a company and its unique needs.

Commonly, businesses update a profit and loss statement each quarter and after each accounting year. Business owners have access to numerous accounting software programs that simplify creating a profit and loss statement. However, it's helpful to become familiar with the profit and loss statement format to adequately assess and prepare your profit and loss statements with or without software programs. A profit and loss statement is divided into five parts; learning what is included in each section is vital for accuracy.

- Revenue: The revenue section on a profit and loss statement refers to the total sales made in the specified period and any money received from selling property, equipment, or tax refunds.

- Cost of goods sold (COGS): When a business sells a product or service, the total earnings aren't the price the customer pays. As a business owner, you're likely aware that the cost of materials and production time must be accounted for.

- General expenses: Rent, computer equipment, office supplies, and utilities can all be accounted for under the general expenses section of your profit and loss statement. These are indirect expenses as they don't contribute to making products or delivering services.

- Other expenses: Interest, taxes, sales of assets, and restructuring costs can all be accounted for under the other expenses section of your profit and loss statement. These are considered non-operating expenses as they don't directly relate to the main operations of your business.

- Net income: After plugging all the numbers into your profit and loss statement, you'll determine how much money remains after all expenses are subtracted from your quarterly or annual revenue. Net income will help you decide, regardless of whether you've profited or lost during the specified time frame.

However, not every expense or revenue is required to be recorded in a profit and loss statement. Expenses on assets and cash injections like long or short-term business loans are typically excluded.

Profit and Loss Statement Terminology

There are many moving parts of a profit and loss report. Becoming familiar with common terminology will help you categorize your expenses correctly and create an accurate profit and loss statement for your chosen period.

- Expenditures: The total purchase price of any goods and services purchased during the specified time frame can be entered in the expenditures section of your profit and loss statement. Total expenditures should be easy to determine, but becoming familiar with the various types of expenditures is recommended to ensure all data is included.

- Gross profit: As a business owner, you're curious about how much you've profited in a quarter or year. Gross profit refers to the amount your company has made after any costs for making and selling products or providing services are considered. You can determine your gross profit by subtracting COGS from your total revenue.

- Operating expenses (OPEX): All costs associated with running your business, such as travel, payroll, advertising, and more, can be accounted for in operating expenses. However, it's essential to determine whether they're COGS or OPEX. The company's size and type usually specify the number of operating expenses a business has.

- Depreciation: Did you know the moment you purchase something new, it loses a portion of its value? They all lose value over time, whether machinery, equipment, or other essential business items. You must account for depreciation in your profit and loss statement, as these numbers can be counted as a loss come tax time.

- Earnings before interest and tax (EBIT): Another common term for EBIT is the operating profit, which determines your company's profitability. You can calculate EBIT by subtracting OPEX from your gross profit.

- Earnings before tax (EBT): Are you curious about how your business performs compared to others? EBT makes that simple as it measures your company's financial performance. You can calculate EBT by subtracting COGS, OPEX, interest, and depreciation from your total revenue.

- Earnings available for common shareholders: Your company might have investors, or you might complete owner's draws in place of a salary. If so, the earnings available for the common shareholder's section of your profit and loss statement will show a net after-tax profit while accounting for any dividends for preferred shareholders.

- Owner's draw: Business owners commonly take money out of company revenues for personal use as this is a way to pay themselves and alleviate the need for a salary.

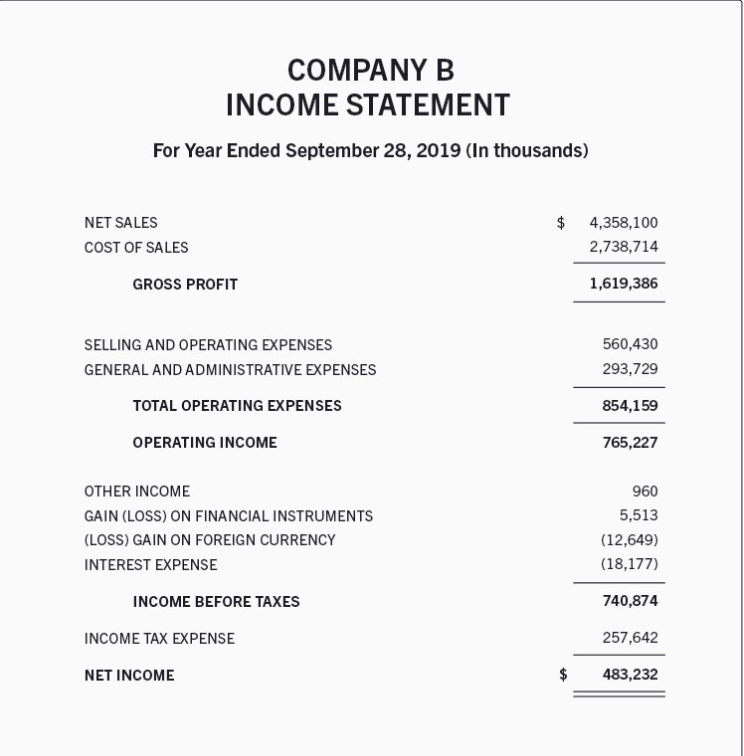

Reading a Profit and Loss Statement

An initial glance at a profit and loss statement example may make it seem daunting. However, business owners worldwide have recognized the value behind sectioning the statement into three categories as this eliminates confusion and complexity.

- Revenue: Taking time to determine how much money your business makes in a quarter or accounting year will help you identify total sales, revenue, and income for a specific time frame. This is usually the first section of a profit and loss statement.

- Expenses: You'll identify how much your business requires during a quarter or accounting year to receive profit. In this section, you'll include general and other expenses purchased materials with a business line of credit, and more. This is usually the second section of a profit and loss statement.

- Net income: Determining your net income for a quarter or accounting year is the sole purpose of a profit and loss statement. Your company's net income will be calculated once all numbers are entered into your P&L statement to help you identify if your business operated at a profit or loss for the specified time frame. This is usually the third section of a profit and loss statement.

After sectioning your profit and loss statement into three categories, each category is broken down into sub-categories so all essential numbers have a home. Once all required numbers are inputted, you can identify gross profit, operating profit, and net income. Your net income will help you determine whether your company operated at a profit or a loss for the quarter or accounting year. Remember, depending on your operation discovery, it may be time to increase revenues, cut costs, or both.

Preparing Your Profit and Loss Statement

Learning how to read and analyze your profit and loss statement is the first step, and once you've mastered this, it's time to start preparing them. Business owners have access to various accounting software programs like QuickBooks or Xero, making managing their books and preparing financial statements simple. Various online resources also offer business owners a profit and loss statement template. These can usually be found by searching "profit and loss statement for small business." If you work with a bookkeeper or accountant, these programs allow timely and efficient collaboration opportunities. However, based on your free time or company size, you may find it more beneficial to independently prepare profit and loss statements. If you choose to complete a P&L statement on your own, these are a few simple steps you can use as a guide:

- Prepare and determine your company's revenue for each quarter of the year.

- Identify your company's quarterly expenses to learn how much your business spent and whether they are categorized as COGS or OPEX.

- Take your company's overall expenses and subtract them from your gross profit. This will help you determine your EBIT for each quarter and the accounting year.

- Any taxes and interest should also be subtracted from your EBIT. Interest charges can be challenging to navigate, so guidance from an accountant with small business experience may be beneficial.

- Learn whether your company operated at a profit or a loss for each quarter and the accounting year.

Profit and loss statement preparation doesn't have to be complicated, and completing preparation on your own can be hugely beneficial. You'll not only learn more about your business operations, but you'll gain clarity as to what changes you can make within your existing business model to increase profit or avoid further loss.

How To Prepare a Profit and Loss Statement?

Simply put, small business owners must recognize the importance of profit and loss statements. While public corporations are required to complete these statements, familiarizing yourself with the process will help you review your net income and identify areas of improvement or SMB financing options. It's recommended that small business owners complete a profit and loss statement regularly, so they can stay informed about how well their business is performing. You can also compare past statements to recent reports, which can help you see your company's progression and market evolution.

Step-by-step guide to write a Profit and Loss Statement

Creating a profit and loss statement requires precision and attention to detail. Here's a step-by-step guide to help you achieve that:

- Start with Revenue: Begin your report with the total revenue earned within the specified accounting period. Include all sources of your business income – sales, gains from asset sales, or even tax refunds.

- Subtract Cost of Goods Sold: If you deal with physical products, subtract your cost of goods sold (COGS). This figure includes the material costs and labor costs directly tied to the products or services your business sells.

- Calculate Gross Profit: Subtracting your COGS from your total revenue will give you the Gross Profit, an important interim figure showing your direct profitability of sales.

- Account for Operating Expenses: The next step is to list and total all of your regular business operating expenses. This can include wages, rent, utilities, advertising, travel, and more.

- Arrive at the Operating Profit: Subtract the operating expenses from your Gross Profit to calculate your company's Operating Profit, which is a measure of how profitable your regular operations are, without considering extraordinary income or expenses.

- Consider Non-Operating Expenses/Incomes: List and subtract any non-operating expenses such as interest paid on business loans. Also, add any non-business income, like interest earned on business savings.

- Find the Net Profit/Loss: After accounting for all forms of income and expenses, calculate the Net Profit (or loss) for your business during that period. This is the bottom line that tells whether your business made money or took a hit.

This outline provides a detailed look into creating a standard Profit and Loss statement. Remember, it's wise to consult with an accountant if you're unsure about any aspects of your financials.

Source: Harvard Busienss Scholl Online

Accounting strategies for a comprehensive Profit and Loss statement

Creating a comprehensive P&L statement requires more than just tallying income and expenses. Here are some strategies that may help:

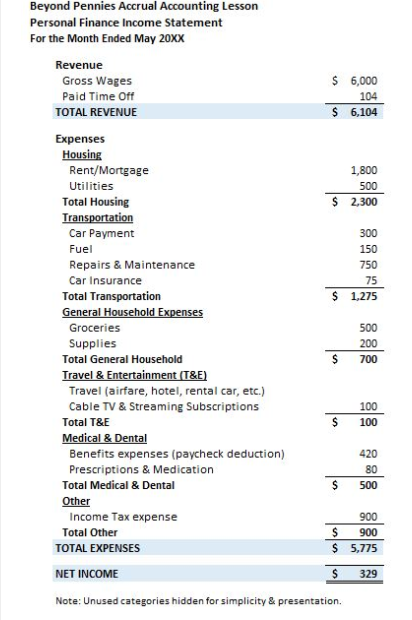

- Use Accrual Accounting: Unlike cash-basis accounting (recording transactions as money changes hands), accrual accounting records transactions as they occur, regardless of payment. This method provides a more accurate picture of financial health.

- Categorize Expenses Properly: Ensure you correctly differentiate between COGS and operating expenses. This accuracy is crucial for calculating gross profit, operating profit, and subsequently, net profit.

- Consistently Allocate Indirect Costs: Indirect costs, like rent or utilities, should be consistently allocated across operating expenses. Inconsistent allocation can distort your profit and cost analysis.

- Separate Non-Operating Items: Separate one-off, extraordinary, or non-operating items from regular income and expenses. This way, you can isolate the performance of regular business operations.

- Don’t Forget Non-Cash Expenses: Expenses like depreciation or amortization do not involve actual cash payments but are significant for tax purposes and assessing asset values. Include them in your P&L statement.

- Forecast Regularly: Use historical data to forecast future P&L statements. Tracking changes and trends in revenue and expenses helps anticipate future profitability and cash flow needs.

Example below of an accrual accounting representation on a P&L statement

Source: Beyond Pennys

Truly mastering P&L statements requires a good understanding of accounting principles. Software can make it simpler, but it’s a tool, not a replacement for financial literacy.

Software Recommendations for Creating Profit and Loss Statements

Overview of best software to create a profit and loss statement

In today's fast-paced digital era, several accounting software programs can simplify the process of creating a profit and loss statement. Let's look at some of the best ones:

QuickBooks Online

As a small business favorite, QuickBooks Online offers robust reporting capabilities, including comprehensive profit and loss reporting. It also integrates with various business tools and provides mobile-friendly access.

Xero

Xero is another excellent choice, providing intuitive P&L statements. The software streamlines financial management with easy-to-understand overviews and details, helping businesses make informed decisions.

FreshBooks

Known for its user-friendly interface, FreshBooks makes it simple to create profit and loss statements. Along with accounting, it offers strong invoicing and time tracking capabilities.

Zoho Books

This software offers robust accounting tools, including detailed profit and loss statements, balance sheets, and cash flow statements, making it easier for businesses to keep track of their financial health.

While each of these software programs comes with its strengths, your choice should be based on your unique business needs, including the nature of your business, the number of transactions, your budget for the software, and the level of complexity of financial management in your organization.

Comparisons of top accounting software

Comparing different accounting software options can help you choose the best one to create a P&L statement for your business needs.

Here's a quick comparison table highlighting key features of each software :

| QuickBooks Online | Xero | FreshBooks | Zoho Books |

| Known for its comprehensive feature set, it doesn't disappoint when it comes to reporting capabilities. | Xero excels in areas of usability and integration. | Apart from its easy-to-use profit and loss reporting, FreshBooks catifies operations with its robust invoicing and project management tools. | Zoho Books is a cost-effective choice for small and medium-sized businesses. |

| You can generate an array of financial statements, including profit and loss statements. | It generates detailed profit and loss statements and even allows for customization according to your business needs. | It is cost-effective for small business owners as it offers different pricing plans for different business sizes. | It supports multi-currency transactions, an added advantage for businesses dealing with global clients. |

| High scalability ensures you can upgrade your plan as your business grows. | Its strong resources for learning are beneficial for beginners. | One potential disadvantage can be its limited capabilities for larger businesses. | Its inventory tracking features may be insufficient for some businesses. |

| It also offers integration with many third-party applications. | You may find its customer support slightly less responsive. | ||

| The downside can be its relatively higher cost and steep learning curve for beginners. |

Make a choice based on the specific needs of your business, taking into account factors like ease of use, support services, pricing, and integration capabilities.

Frequently Asked Questions

What is operating profit?

Operating profit, also known as EBIT (Earnings before Interest and Tax), is a profitability measure that shows how much profit a company makes from its primary business operations, without considering interest or tax. This figure is reached by subtracting COGS, and all regular operating expenses, from the total revenue. Operating profit is a crucial indicator as it reflects the core profitability of a business from its day-to-day operations.

Operating profit is an important financial metric that calculates the profit earned from a firm's normal core business operations. This value does not include any profits earned from the firm's investments (such as earnings from firms in which the company has partial interest) and the effects of interest and taxes.

To calculate the operating profit, deduct all direct costs and overhead costs associated with the normal operations of the business from the gross income. The formula is:

Operating Profit = Gross Profit – Operating Costs – Depreciation – Amortization

Operating profit is often referred to as Earnings Before Interest and Tax (EBIT), although technically, EBIT can include non-operating income and expenses, which are usually not included in the calculation of operating profit.

It's a valuable measure because it indicates the profitability and efficiency at the operating level. It is also a good figure to look at if one wants to strip out the effects of financing and accounting decisions like interest and taxes.

How to interpret net profit?

Net Profit, also known as net income or net earnings, is the amount that remains after all operating expenses, interest, taxes, and preferred stock dividends (but not common stock dividends) have been deducted from a company's total revenue. In simpler terms, it's the revenue left over after all costs have been subtracted.

Interpreting net profit is quite straightforward: if your net profit is positive, your company is generating more income than it consumes in expenses, signifying a profitable status. If it's negative, your business is spending more than it earns, indicating a loss.

It's also helpful to compare net profit figures over periods to recognize trends and examine the growth or decline in profitability.

A higher net profit margin indicates a more profitable company that has better control over its costs compared to competitors. It's one of the most crucial numbers on a profit and loss statement.

What does a Profit and Loss statement tell about the health of a business?

A Profit and Loss (P&L) Statement, also known as an income statement, serves as a report of a company's revenue, costs, and expenses over a period of time. It provides substantial insight into the financial health of a business.

At the most basic level, the P&L statement tells you whether your business is profitable or not. If your revenue exceeds your costs and expenses, you're making a profit. If your costs and expenses exceed your revenue, you're operating at a loss.

Beyond profitability, the P&L statement can further reveal:

Revenue streams: It can highlight your most significant sources of income, suggesting where you might want to focus your marketing efforts.

Expense management: It can show you where your money is going, which can help you cut wasteful expenditures or make more effective budgets.

Progress over time: Regularly produced (usually quarterly and annually) P&L statements can demonstrate whether your business is improving, stagnating, or declining.

Financial ratios: Various financial ratios (profit margin, operating margin, etc.) derived from P&L can provide crucial insights about business efficiency and profitability.

In summary, a P&L statement tells you not just whether you're doing well, but also helps you understand why and how you can further improve. Carefully reviewing and understanding your P&L statement is an essential part of managing your business's financial health.