The US Small Business Administration (SBA) oversees a $131 billion portfolio of loans and loan guarantees. If you’re a small or medium-sized business owner, you might wonder: how can I get a piece of the pie? After all, SBA loans are among the safest and most affordable debt financing solutions for small business owners.

Although applying for an SBA loan is relatively easy, it’s not so easy getting approved. If you aren’t careful with your application, you can get rejected and lose out on millions in low-cost, government-backed financing, so you may wonder how to get SBA loan approved.

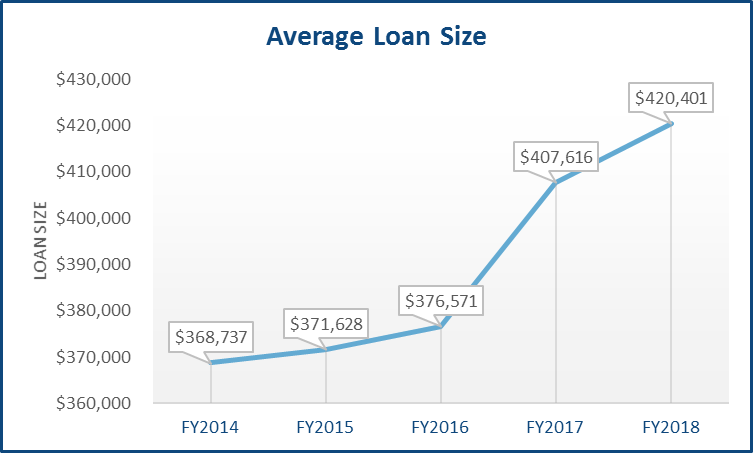

In 2020, don’t let your business miss out on low-interest funding. With the average SBA loan exceeding $370,000, you must nail your application forms and check every box properly before you apply for an SBA loan. In this guide, we’ll show you how.

SBA Loans 101:

What Is a SBA Loan?

Unlike banks and traditional institutional lenders, the SBA is an agency of the US federal government. Therefore, all loans granted by the SBA are driven by the publicly funded SBA lending process.

These loans are delivered through a myriad of SBA loan programs, and approximately 90 percent of all loans provided by the agency are secured. The SBA partners with banks and other financial establishments to provide budget-friendly loans for Americans via their highly competitive programs such as the SBA 7(a) express loan and working capital loan, among others. These are all part of the SBA's mission to foster business growth.

The SBA's role as a government agency committed to propelling domestic business development makes it a prime source for some of the most accessible loans for business owners in the United States. However, businesses must satisfy specific requirements within the SBA lending process to be eligible.

SBA Express provides the easiest and most simplified SBA application procedure, expedited approval times, extended repayment periods, and reduced down payment prerequisites compared to traditional loans.

Types of SBA Loans

Not all SBA loans are the same. There are different types, all falling under various SBA loan programs, that you, as a borrower, can apply for depending on your business’s requirements, whether for export working capital, microloan funds, or for purchasing machinery. We’ve outlined the various SBA loans available to small business owners below.

- SBA 7(a) Loans: This popular type of SBA loan, the SBA 7(a) loan, is an excellent choice for those seeking long-term working capital or purchasing machinery for their business. These loans also include options like the SBA express loan for expedited processing and the working capital loan geared towards businesses requiring additional financial support for export sales. Approximately 50,000 SBA 7(a) loans are given annually for different purposes, from business growth to refinancing business debt.

- CDC/504 Loans: Also known as SBA 504 loans, these are identified as certified development company (CDC) loans. They carry a larger value and lend support for purchasing significant fixed assets such as long-term machinery or funding capital projects that might be too expensive for business owners, such as acquiring an office or executing new renovations. Typically, CDC/504 loans cover about 15 percent of the project’s total cost.

- Disaster Loans: For businesses affected by a natural disaster, SBA Disaster Assistance with special dedicated loans could help replace lost property, equipment, or real assets due to natural causes.

- CAPLine: For small business construction projects, the SBA's CAPLine program provides export working capital valued at up to $5 million and being 85 percent guaranteed (secured) by the SBA.

- SBA Microloan: This type is known as the microloan, which the SBA provides to intermediary lenders—nonprofit community-based organizations with experience in lending and business management. These organizations then issue microloan funds to small businesses, which can be used for working capital or purchasing machinery among other things. Keep in mind that microloans can't be used to buy real estate or clear any business debt.

The chart above shows that the average SBA 7(a) loan size was $420,401 in the Fiscal Year 2018. However, depending on your business's capital requirements, you can apply for larger (CDC/504, CAPLine) or smaller (SBA Microloan) loans.

In Fiscal Year 2018, the average SBA 7(a) loan size increased to $420,401. However, depending on your business's need for capital- for instance, if you are looking into export working capital or in need of microloan funds - the borrower information form can help determine the right SBA loan program for you.

Your options vary from major loans like CDC/504, CAPLine, to smaller options like SBA Microloans. If required, the SBA's free online Lender Match tool is at your disposal, designed to connect small business owners with SBA-approved lending partners. Bear in mind, every loan type comes with its unique lender eligibility requirements, conditions-of-use, and repayment terms.

SBA loans are highly competitive, with the loans boasting low, fixed interest rates and repayment terms extending up to 30 years in general, although for some, the repayment terms can extend up to six years and interest rates can range from 8% to 13%.

SBA Loan Minimum Requirements

Qualifying for an SBA loan is generally easier than a standard secured bank loan. The SBA is slightly more lenient on certain credit qualifications than a bank or a credit union, making the process of closing on your loan with minimized potential liabilities considerably smoother. However, the SBA maintains a few broad standards that all applicants must meet to ensure qualifications and minimize any chances of defaults in the loan repayment. A crucial aspect of these broad standards includes understanding the repayment terms.

This is typically where a well-constructed resume, highlighting your understanding of the term 'closing,' can give you an edge:

- Eligible businesses must be legally incorporated and for-profit

- Eligible businesses cannot receive funding by other means

- An owner with equity in the business must operate eligible businesses

- Eligible businesses must be located and operated in the US

When considering your credit score, it’s likely you'll need a minimum score of about 680 to pass the underwriting process and have your loan application approved. This process may involve putting up collateral or personal assets, with a closing on a personal guaranty being generally required. In some cases, FICO scores in the low 600s may be forgiven of potential liabilities and given the closing green-light, provided other aspects of your application are strong and the repayment terms are favorable. Generally, the higher your credit rating, the more likely your application will close successfully through the lender's underwriting examination.

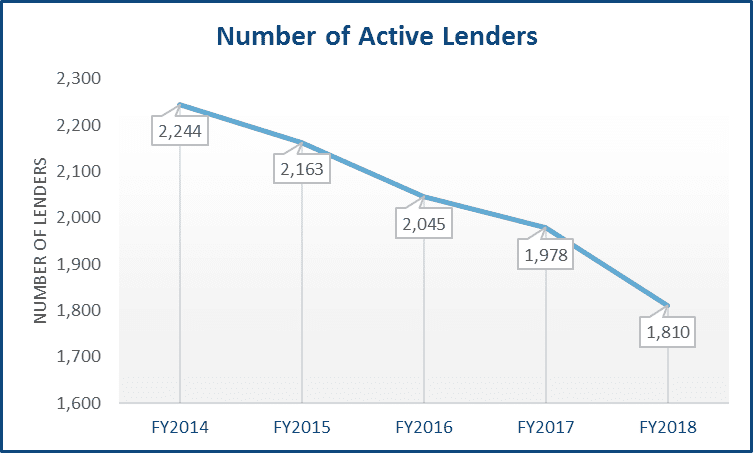

The above chart indicates that the number of active lenders in the US has significantly diminished since FY2014. Issues such as limited liquidity have resulted in an increasing concentration of lenders for small businesses, emphasizing the necessity of understanding liabilities, repayment terms, and the nuances of closing. Using an effective online portal like SBA's lender match tool can be crucial for finding the right lender plan for your business needs. In essence, the SBA provides a beacon of hope for business owners who might otherwise struggle to access startup capital or secure a loan business lease with desirable closing and repayment terms.

A Note on How The SBA Works

The SBA isn’t a typical lender. In fact, it's an intermediary working with other financial institutions like traditional lenders, online or alternative lenders, under various SBA loan programs. Your business might meet the SBA eligibility requirements if, among other conditions, it is officially registered, for-profit, and operates in the U.S. A crucial aspect to note is that you may qualify for an SBA loan, such as the SBA 7(a) or SBA express loan, if you've exhausted all other financing options.

The SBA, instead of issuing loans itself, functions as a guarantee for these lenders within their loan programs. The SBA steps in to help mitigate the risk lenders take on when they issue you a loan, thus making securing a typical bank loan easier. If the loan goes into default, the SBA recompenses the lenders to help them recover their losses. This reduces the lender's risk significantly.

Only "preferred lenders", often spanning from well-established banks to nonprofit organizations with proven proficiency in lending and business management, are eligible to grant SBA-backed loans. These organizations, including some specific nonprofit groups, are part of the small business financing options that work in tandem with the SBA loan programs. The set of these preferred lenders is diverse, ranging from large, commercial banks to Certified Development Companies (CDCs) under the SBA 504 loan program, ensuring a wide array of financing avenues for your business.

Applying For An SBA Loan in 5 Steps

Now that you know your options, let’s start with the SBA loan application process. Below, we’ve segmented the process into five steps that make applying for a loan through the SBA easy. We’ll cover everything from the pre-planning stage to the pitch presentation that you’ll make to a loan officer.

Step 1: Find Your “Why”

Ask yourself: why do I need a small business loan? Perhaps, it's to pave the way for your startup funding or to scale its operations. Whatever the reason, both the SBA and the lender will require a comprehensive business overview encapsulating your financing needs as well as your eligibility for SBA loan programs.

How much startup loan do your projections show you need, and for how long? You ought to ask yourself these pertinent questions to craft a robust application for an SBA loan, taking into account variables such as repayment terms and loan fixtures. Make sure to weigh all your options, like the SBA express loan and the working capital loan, before settling for a standard SBA loan, as there exists an array of alternatives including numerous standard bank loans and lines of credit to small business owners.

An SBA loan, like any other loan, should be your last resort. Careful deliberation is necessary as you would be binding yourself to repay this debt—along with interest—over a fixed period, which can impact your cash flow in the long run. Moreover, the need for a startup loan should always be legitimate and pragmatic. Consider the amounts you need—microloan for short-term finances of $25,000 or less or a standard SBA 7(a) loan—aligned with your startup's precise financing requisites.

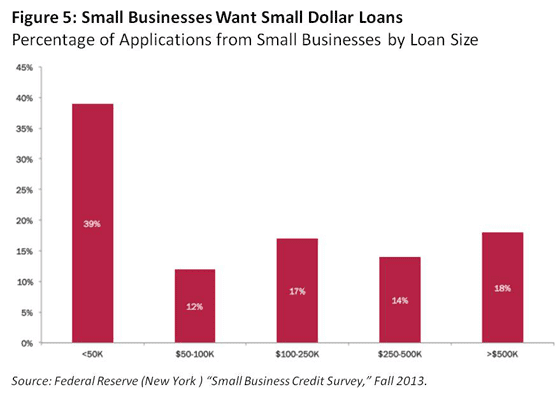

The chart above illustrates that the majority of small business owners necessitate loans of $50,000 or less. If your business falls within this bracket, reevaluate applying for long-term debt financing options like an SBA 7(a) or CDC/504 loan. Extending debt obligations could potentially confine your business's expansion and cloud its prospects for enduring success. Besides, be sure to closely read and comprehend your lease agreement, as it may influence the nature of the loan aligning best with your business plans.

Bear in mind to always ground your decisions on both strategic and financial projections. Your lease agreement could also bear significant influence on your decision regarding the optimal type of loan to apply for. Make a comprehensive and forward-thinking decision that caters to your business's unique financing needs and remains beneficial in the long run. All these factors – understanding SBA loan programs, considering repayment terms, and balancing immediate financing requirements against future financial obligations – are crucial in making the right choice.

Step 2: Start Your Search

Once you’ve analyzed the various debt financing options available to you and settled on a specific type of SBA loan, you can move forward with the application process. SBA loan programs are known for being competitive as they cater to diverse requirements, so it's crucial to choose wisely. Instead of conducting just a regular Google search, consider leveraging the free online tool, SBA Lender Match, to connect with SBA-approved lenders that best suit your business’s needs. For example, you can search “Best SBA lenders for electricians” to find lenders who not only collaborate with the SBA on loan programs but also have a history of approving loans for small electrical businesses.

Once you’ve found a list of potential lending options, you should examine their eligibility criteria, as the SBA sets a range of general requirements that businesses need to meet. Banks, large multinational ones, for instance, typically have the strictest requirements when it comes to small business lending. You often need to meet high standards, such as securing a FICO score above 600, and possessing high-value assets which the loan can be secured against.

Also, ensure that you provide yourself ample time to apply and get the loan reviewed. Large banking institutions like Wells Fargo or JP Morgan Chase may require more time due to their size. Smaller lenders, on the other hand, may offer quicker services like SBA express loan programs, typically approving or rejecting loan applications within 90 days of receiving them. Within two business days, you will likely receive an email with contact information for interested lenders or you can get in touch with the lenders directly via their loan website. Remember to input the correct zip code when applying as this may affect your match results.

Step 3: Boost Your Credentials

Don’t bother applying for an SBA loan unless you’re prepared to put in some legwork to get the loan approved. Before filing your application, work on amplifying your credit qualifications. Making several consecutive on-time payments on your outstanding loans or lines of credit can bolster your credentials. If you're lucky, your timely payments will enhance your FICO score, an essential aspect of the strenuous requirements set by competitive SBA loan programs. This increase can thereby heighten your chances of approval.

Regrettably, sometimes you only get one shot at applying for an SBA loan through an individual lender. Expertise in dealing with the expectations of different SBA loan programs becomes advantageous as you won't get approval during subsequent attempts if you aren’t approved the first time, with programs ranging from SBA 7(a) to CDC/504 loans. Optimizing your application, then, necessitates solidifying your qualifications.

There's no need for concern about approval for an SBA loan if your FICO score exceeds 600. However, fine-tuning your credit qualifications is never futile. For those with an excellent credit score (i.e., 750 or higher), your financial expertise might qualify you for benefits like low-interest rates or favorable terms under SBA loan program types like the SBA express loan or a working capital loan, resulting in substantial long-term savings.

Step 4: Collect The Documents

After you’ve settled on a loan type, the institution you want to apply through, and your FICO score is as high as it can be, you can gather the necessary documents. Such as the borrower information form and other important documentation to substantiate your application for the SBA loan programs. Although the documents and paperwork required will vary from lender to lender, virtually all financial institutions will ask for these poignant pieces of borrower information when you apply for an SBA loan:

- Government ID (1 piece)

- Last year’s tax returns and financial statements

- Articles of Incorporation

- Permits and license certificates

- Proof that you own the business

Never show up unprepared to apply for an SBA loan program, such as the SBA express loan or a working capital loan, without at least the basic documents listed above. It is a nuanced process and meeting the top requirements is crucial, as the lender and the SBA will thoroughly analyze your application, credit history and the extensive documentation you've provided.

Your SBSS score will be calculated based on the range of general requirements for eligibility under the SBA loan programs. No matter where you apply, you will require these documents so the loan officers can authenticate your identity, prove that you’re a part of the business, and assess the risk of lending to you.

Step 5: Apply and Pitch

You’re finally ready to apply for an SBA loan. Believe it or not, this part is actually the easiest of them all. You've exhaustively scrutinized your business needs, compiled all the necessary documents, and developed a solid comprehension of the various SBA loan programs, including export loans and export working capital. Under these programs fall unique options such as SBA express, Microloans, and a working capital loan tailored primarily to support the needs of export businesses. These options can fund capital expenditures like machinery or inventory required to boost your export sales.

The application process is straightforward—you can either approach your local bank branch or opt for an online application via an alternative lender. In case you decide to visit the bank, you'd need to schedule a meeting with a loan officer. This is the stage in which you'll showcase the paperwork you've accumulated and deliver your business pitch. During your pitch, your goal is to demonstrate your business's eligibility for the loan, elucidating why you need the loan, your ten-year financial forecast, loan timeline, and the scope of the project for which the loan is required.

Also, crafting a persuasive business plan to reveal your business model's viability will help minimize any perceived loan risk from the lender's point of view. It's vital to rehearse your presentation multiply times before delivering it in person, ensuring a smoother journey towards securing the loan.

Are You Ready For An SBA Loan?

Although it may seem difficult, applying for a loan is straightforward. If your credit score is robust, you can visit your local bank or financial institution to explore various SBA loan programs. With just a few hours, you can easily start the process, and within days make a remarkable pitch to a loan officer. Along with a strong pitch, meeting the general requirements set by the SBA can speed up your application. With an SBA-backed loan, equipped with competitive repayment terms and possibly low, fixed interest rates, you could embark on a journey to take your business to new heights in 2024.