Both delinquency and default are loan terms that refer to missing payments. While on the surface, these two consequences may seem quite similar, they have many distinguishable differences that borrowers should be aware of.

Delinquency occurs when a payment is late (as little as one day). It can also occur when a borrower misses their regular payment installment. On the other hand, a loan defaults because a borrower fails to repay on their loan's terms in the promissory note agreement or doesn't keep up with their ongoing loan responsibilities. A default can also result from making insufficient payment amounts as well.

Loan terms have a promissory note agreement, a written promise by the lender to the borrower that encompasses the amount and when payments are due. While there are many promissory note agreements, they all lay out specified amounts that must be paid according to the agreement.

What Is Delinquency: What Are Delinquent Business Loans?

Payment delinquency or a delinquent business loan is when a borrower misses their due date or fails to pay for any financing. Financing includes credit card balances, student loans, various kinds of small business loans, car loans, and mortgages.

There's not a lot of leniency with delinquency, either. A late payment is considered delinquent, even by as little as one day. Regardless if a borrower has never been late on a payment before or they have been past due on payments in the past, it's still delinquency. Past history doesn't play a significant role here, so it's important that borrowers are keeping up with their terms and making agreed-upon payments — on time.

What Are the Consequences of Delinquency

Late or insufficient payments can have some unfortunate consequences. The loan provider defines the result of delinquent payments in the loan agreement. That being said, delinquency can spur some fairly substantial consequences depending on what type of loan it's associated with, how long the delinquency occurred, and the cause of delinquency.

So, what are delinquent loans? A delinquent loan may include the following:

- Late fees

- An increased rate of interest

- Your overdue payment may be sent to credit agencies

- You may be continuously contacted by the lender regarding the payment collection

Let's take a deeper look at the effects of delinquent loan payments.

Late Fee Structure for Delinquent Payments

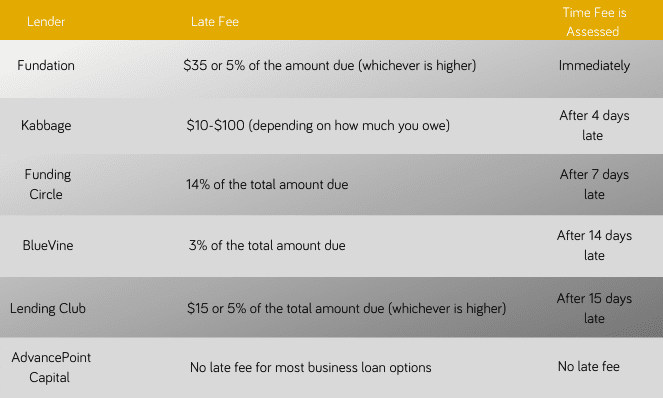

Most loan agreements allow lenders the ability to assess a late fee after a grace period (typically a few days). However, certain loan agreements may enable a lender to increase the interest rate on the overdue payment, commonly referred to as a penalty or default rate. Although, this scenario is far more prevalent with credit cards.

Most lenders will charge late fees laid out in the loan agreement. Every lender is different, and late fee arrangements will be distinct depending on the specific lender. So it's important for borrowers to know the possible consequences of payment delinquency with their specific lender. So, a lender may instantly charge a late fee (even after just one day), while others may offer more leniency with a grace period of a week or so.

Online alternative financing solutions may automatically deduct payments from a borrower's bank account. If there are insufficient funds on the borrower's behalf, the loan payment would become delinquent.

How Delinquent Payments Affect Credit

After your payment is 30 days late, lenders can report a borrower's delinquent payment to a credit bureau. Even if a borrower has been charged a late fee, lenders cannot report delinquent payments earlier than 30 days.

However, after that period, a late payment can seriously damage one's credit score. Payment history significantly impacts credit scores, and even one late payment sent to one of the three major credit bureaus may drastically lower a credit score depending on three factors.

- How late is the payment

- How frequently do delinquent payments occur

- Current credit score

Dings on credit scores can drastically reduce future opportunities for business financing — and for a substantial period of time. Late payments can remain on a borrower's credit history for up to seven years.

Business credit reports operate differently. Commercial credit bureaus don't require a 30-day waiting period to receive reports of delinquent payments. Lenders can report a delinquent payment after just one day.

While repaying the lender after payment becomes delinquent can help reduce the effects on a credit score, the impact on a borrower's credit report won't change.

Dealing With Constant Contact With Delinquent Loans

Borrower that has gone past due on their payments can expect to be contacted frequently by their lender. Lenders will attempt to collect a delinquent payment by phone or email as quickly as possible. The later a payment becomes, the more difficult it can be to collect payments.

According to a survey conducted by the Commercial Law League of America, the percentage of uncollected debt can jump from 7.4% after one month — to 16.6% after two months. This number nearly triples as the delinquency period reaches six months, at 45.3%.

For this very reason, lenders will do everything in their power to collect delinquent payments fast. As a borrower, no matter how late you are on payments, it's important to make payments before the loan goes into default. Consequences are far more severe in this case, and it can save you from a world of long-lasting issues to make payments quickly.

Who Should Worry About Delinquent Payments

Business owners typically require financing solutions to help with the progress of their company. These loans may equate to a substantial sum of capital. Typically, traditional loan avenues like banks will have late fees and severe consequences for delinquent payments, while alternative lending solutions may have more leniency.

Default Loans

When a borrower fails to repay their small business loan as outlined in the terms laid out in the promissory note, their loan goes into default. While every borrower has a plan in mind regarding repaying their business loan, unexpected turbulence can occur that affects revenue and the ability to make loan payments.

While unfortunate and oftentimes unforeseen, failing to make payments can result in loan default, which can drastically affect a borrower's credit history and much, much more. Access to capital is essential for business owners, and default loans can diminish future opportunities. According to the Federal Reserve, consumer loan default rates from banks are roughly 2.54% compared to commercial loan rates, which hover around 0.94%.

Every lender handles loan defaults differently, and the type of loan, along with what is laid out in the loan agreement, can affect the consequences of defaulting on a loan. The events that trigger loan defaults depend entirely on the lender and type of loan. While most lenders require multiple missed payments and a specific time frame before they count a payment as a default, others (for business loans) may incur this penalty after one missed payment.

Lenders will attempt to contact a borrower who has missed payments, as we mentioned with delinquent loans. These contact methods will become increasingly aggressive as time passes, and consequences may vary depending on the loan agreement. Generally speaking, some common penalties are associated with a defaulted loan.

Reduced Credit Score Related To Default Loans

Missed payments are sent to credit bureaus, negatively impacting a borrower's credit score. As mentioned, late payments will stay on a credit history for a significant time (up to seven years).

The more payments a borrower misses, the more harm they cause to their credit score.

Legal Risks With Default Loans

One of the more frightening consequences of a loan default situation is the legal claims that may occur. If an account is sent to a collection agency, the borrower will certainly receive a lot of collection attention through calls and emails.

However, the more worrisome component is that a lender can sue to collect the debt owed. A lender may also attempt to liquidate any collateral that a borrower has put up for the loan, such as expensive machinery or equipment in the case of equipment financing. Dealing with legal action can be an expensive and painstaking process that business owners should avoid at all costs.

Consequences Of Default Loans

As previously stated, defaulting on a loan can result in expensive legal actions, but it doesn't stop there. In addition to the late payment fees that a lender may charge, the damage to a borrower's credit score can make future financing far more costly.

Future loans will not only be more time-consuming and difficult to obtain, but the interest rate will also be significantly higher.

Defaulting on a Secured Loan vs. an Unsecured Loan

Both secured and unsecured loans manage defaults differently, so it's important for borrowers to be aware of the discrepancies between the two.

First, knowing the difference between the two types of loans is important before diving into the consequences of defaulting on a payment. A secured loan is a loan where the collateral is put up in exchange for capital, while an unsecured loan doesn't require any collateral. Instead, unsecured business loans require a personal guarantee from the borrower. Lenders may also place a lien on all business assets.

Secured Loan

Defaulting on a secured loan can lead to several outcomes. Depending on the lender, there may be some agreement leniency before any drastic actions take place. However, lenders may seize the collateral to liquidate and take back the capital. Depending on the state, lenders may be able to seize the collateral without a court judgment.

That being said, lenders try to avoid seizing capital because it expends many resources and can be expensive. More often than not, a payment plan will be worked out to make back the money.

Unsecured Loan

Defaulting on an unsecured business loan that doesn't require any collateral usually results in a series of late fees (depending on the lender). The interest rate on the unsecured loan may also be increased, which can be expensive. If a lender cannot collect on their unsecured loan, they may file a lawsuit against the business. This can result in seizing business assets such as real estate or vehicles or perhaps the lender garnishing money from the business bank account.

What About SBA Loans?

Defaulting on an SBA loan can be a seriously tricky situation. Banks provide a percentage of SBA loans; however, these are two-part loans. The remaining percentage is provided by the SBA itself, an entity of the federal government. As one could imagine, failing to repay the federal government can have severe consequences, and they will do their part to collect on the loan.

Here's what may happen if a borrower defaults on an SBA loan.

- The bank will attempt to collect what is owed under the terms in the SBA loan agreement. Many SBA programs require some sort of collateral, which may be seized in the event of a defaulted SBA loan.

- If the amount of collateral isn't sufficient to cover the amount owed, a lender will then file a claim with the SBA to collect.

- The SBA gives borrowers 60 days to pay on the defaulted loan. Because the SBA is a part of the federal government, it's similar to an IRS situation. The SBA may propose an Offer in Compromise, which basically states that a borrower must pay a percentage of the amount owed depending on the business's finances.

- If all else fails, the U.S. Treasury Department will intervene and can collect from bank accounts, garnishing tax refunds, wages, and more for however long it takes to get the money back.

Tips for Avoiding a Defaulted Loan

Defaulting on a loan can be a costly problem, not to mention the future consequences that can affect business and one's life. Sometimes, the best way to combat a defaulted loan is to avoid it in the first place.

Here are some helpful tips for avoiding a defaulted loan.

- Pay whenever you can, even if it's not the entire amount. Smaller payments, when affordable, can help mitigate the chances of default, and lenders are able to see that a borrower is making an effort.

- Contact the lender as soon as possible. Lenders understand that business owners may have hit a rough patch or are having trouble with payments — but they will be far more understanding if they have a heads-up. A lender may extend the loan term, arrange a payment plan, or even defer some payments before the issue becomes substantial. Communication is the key to avoiding serious consequences.

- Get help. Sometimes, consulting a debt counselor or bankruptcy lawyer is the best option. A borrower can get a professional opinion and possibly a debt management plan, which will help with avoiding more serious consequences. If those consequences are unavoidable, a bankruptcy lawyer can help.

Moving Forward

Both loan delinquency and loan defaults can be costly for a business owner. It's essential that borrowers understand the terms and are prepared for the payments ahead to avoid more costly situations.

Not only can your credit score be affected, but incomplete payments can stunt future options and growth. A contingency plan should be implemented to lessen the eventual blow if a borrower is worried about missing a payment. Contacting the lender can help, as they're not too keen about surprises or having an unresponsive borrower come payment time. Delinquency can be managed, but defaulted loans may have severe and long-term consequences. Seek counsel and assistance if you are in a default situation because the faster you get in front of the issue, the easier it will be.