What is a Small Business Administration (SBA) Loan?

The Small Business Administration is a federal government agency that helps business owners around the country who have the drive to be entrepreneurs establish, build, and grow their businesses successfully through SBA offers such as a small business loans. The Small Business Administration (SBA) is not the lender, but instead a government agency that offers a wide range of business loan program guarantees of up to 85% of the loan amount provided through an SBA-approved lending institution. This partnership approach ensures entrepreneurs have access to necessary capital while stimulating the economy by reducing risk for the lenders. Some of these lenders have revolving lines of credit of up to 10 years.

These Small Business Administration types of SBA loans provide low-rate and long-term financing solutions with some of the most attractive interest rates that you can take advantage of today. By acting as a catalyst for various lending institutions, these loans mitigate the level of risk to lenders because of the SBA guarantee, encouraging lending compared to traditional bank loans.

The three main SBA loans provide funding solutions that can be used for a wide range of business purposes. The SBA offers many uses but is not limited to, everyday expenses, equipment, and inventory refinancing debt. These three loans include the 7(a) Loan Program, SBA’s Microloan Program, and the CDC/504 Loan Program.

Get Started Today

AdvancePoint Capital makes the loan application process a simple, straightforward experience.

How to Qualify for an SBA Loan?

Although the application and approval process for an SBA loan may be complicated and lengthy, many businesses have a solid chance of approval because the nature of the program is to support small businesses and provide a small business loan. Understanding the eligibility criteria is crucial in navigating the intricacies of the Small Business Administration's lending program. With one of the best interest rate spectrums out there, these loans can be a sound option for both small businesses and startups alike—offering a solid foundation to create a successful enterprise.

So, how does a business owner go about obtaining an SBA loan? Qualification depends on many factors, including your personal credit score, which is a key indicator of creditworthiness. While it’s not the sole deciding factor, it does have a significant impact. SBA loans are primarily for business owners with strong credit profiles. If you need instant financing, SBA loans aren’t typically the fastest avenue—as it can take a while to get approved.

To navigate the loan application paperwork efficiently, you must be prepared and able to put together a quality, thorough application that will require time, energy, attention, and more paperwork. The SBA loan application process is daunting, but being well-prepared can ensure a faster decision and approval. However, you should still expect it to take weeks, not days. SBA loans aren’t a quick cash flow solution— so it’s important to know this information going in. The SBA guarantees these loans and makes sure every "I" is dotted and "T" is crossed, which takes time. If instant business loans are what you seek, consider a wide range of alternative lending solutions for a small business loan from AdvancePoint Capital.

Types of SBA Loan Programs

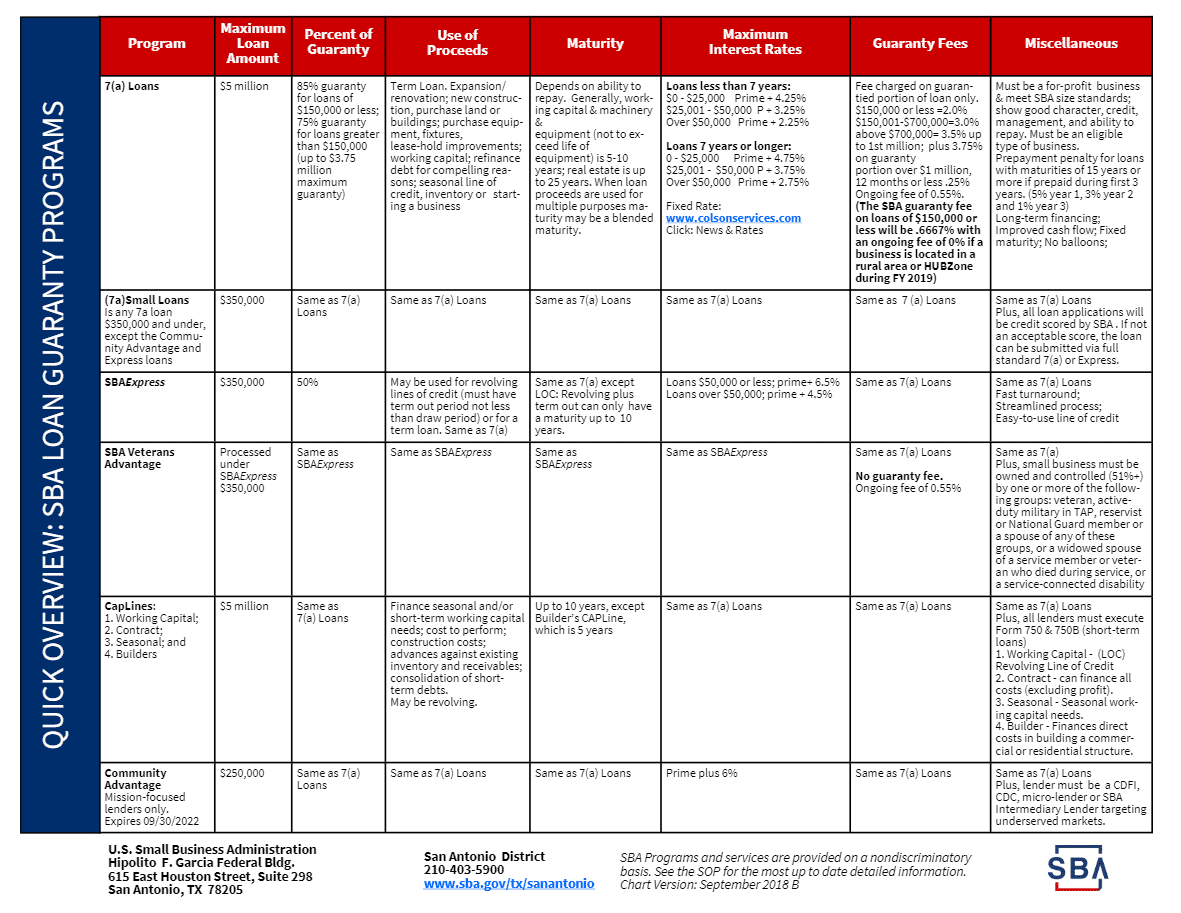

Discover the many different options out there for SBA Loans. The three most popular Small Business Administration SBA guaranteed loans for small businesses include:

- The 7(a) Loan Program – The choice for businesses looking to access working capital, consolidate business debt or start up their business.

- The Small Business Microloan Program – Through this program, the SBA loans work as a third party to loan money to an intermediary nonprofit lender. From those lenders, startups and small businesses receive loans of up to $50,000 to run their companies.

- The CDC/504 Loan Program – This program provides long-term, fixed-interest rate financing to small businesses that are trying to expand or modernize and have fixed assets for collateral such as real estate.

7(a) Loan Program

Many small business owners choose the 7 (a) loan program for their first SBA loan. These loans are considered general-purpose small business loans that offer incredible flexibility with how they can be used by a small business. Whether it’s for working capital, consolidating business debt, acquiring real estate, or other business-related purposes, a 7(a) loan provides a well-suited financial tool — an ideal choice for diverse business needs. Given its versatility, it's no surprise that many entrepreneurs opt for this program as their primary foray into SBA financing.

While the 7(a) loans are flexible, they aren't a catch-all solution; there are restrictions. You cannot utilize this SBA loan for delinquent taxes, to facilitate a buyout of a business partner, or to compensate an owner for prior business expenses or debts.

The 7(a) program includes several sub-programs, which cater to different business demands with their tailored structures and uses. Some of the prevalent sub-programs encompass:

- SBA Express

- 7(a) Small loan

- Veterans Advantage

- Export Working Capital

- Export Express

- CAPLines

The interest rates of a 7(a) loan are competitively low, making them a highly cost-effective option for eligible borrowers. Maximum interest rates are capped by the SBA, but actual rates can vary as lenders determine them based on the borrower's creditworthiness, within SBA's specified limits. When it comes to loan maturities, they typically extend from 7 up to 25 years, with repayment terms on the upper end for real estate loans, reflecting the need for longer maturities for sizeable investments. Fees typically range from .25% to 3.5% of the loan's guaranteed portion, relatively low in comparison to non-SBA loans. Monthly payments are flexible, consisting of principal and interest, and tailored to match the business's cash flow; this aligns perfectly with loans intended for working capital, as these require shorter repayment terms, aligning with the day-to -day financial strategy of the company.

In summary, the SBA 7(a) loan program stands out for its versatile financial support, competitive interest rates, and accommodating repayment terms designed to meet various business milestones and operational needs. Whether the funds are meant for immediate working capital or long-term property investments, these loan maturities reflect an understanding of diverse business timelines, ensuring that small businesses can thrive and grow unfettered by inflexible financial constraints.

SBA Microloan Program

This type of SBA loan program works best with businesses with extremely high startup costs or overhead. The SBA Microloan Program can help businesses that may be looking to borrow smaller amounts of money rather than hundreds of thousands to millions of dollars.

A traditional bank loan is very difficult for business owners to obtain, especially if the loan amount is less than $50,000. Those looking for various types of capital for operational expenses don’t typically need to borrow massive amounts of money. That’s where SBA microloans come into play.

While we did state that the SBA is not a lender, the SBA Microloan program is an exception. Funds for this type of SBA loan do indeed come from the SBA. These loans can be used for a wide variety of purposes as well, including advertising, marketing, purchase materials, and payroll. Although SBA microloans offer a lot of diversity in regards to how they can be spent, they can’t be used to purchase real estate or refinance debt.

This SBA loan option is perfect for business owners that could see a significant impact from lending less than $50,000. Most of the time, the Microloan Program requires some sort of collateral on the loan along with a personal guarantee. However, the personal credit score requirements are fairly lenient at around 650.

The Microloan program has much shorter terms than other types of loans and can have terms of up to six years with a fairly average interest rate.

SBA CDC/504 Loan Program

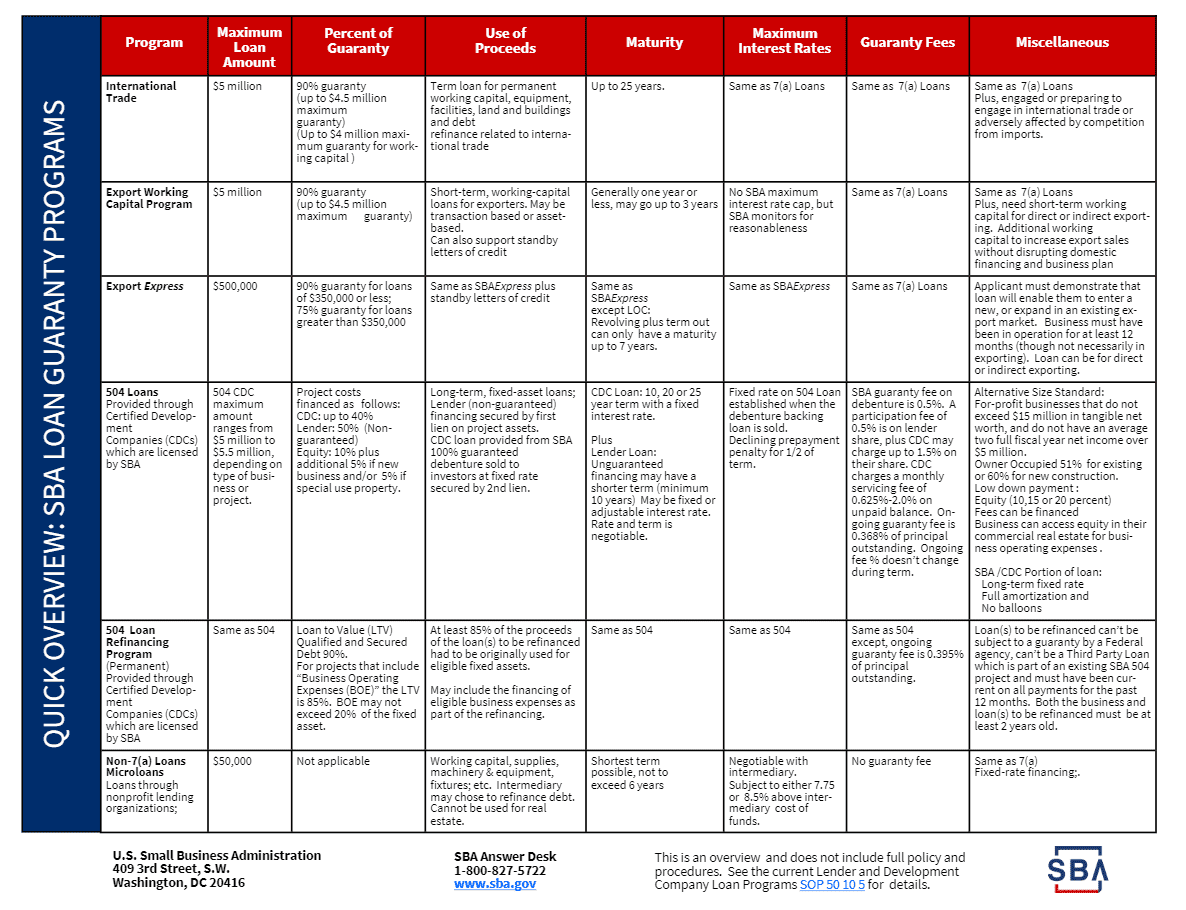

If you’re looking for significant funds to expand, need a more long-term funding solution, or want SBA loans to purchase major fixed assets, or perhaps refinance existing debt — a CDC/504 loan may be the right choice. As you may imagine, the process and qualifications for SBA loans of this nature are far more involved and complicated, requiring multiple parties for a much longer and tedious undertaking.

Note: 504/CDC Loans have no set maximums.

Breaking down the 504/CDC foundations can be a bit complex due to the big-budget nature of the financing. A bank typically funds up to around half of the project’s costs, while a nonprofit associated with the SBA finance around 40%. The remaining capital for the SBA loan comes from you, usually as a cash down payment. This structure often benefits businesses looking for equipment acquisition to ensure they have the most up-to-date machinery. If a small business takes a step back and looks at the borrowing structure, it becomes clear that you’re taking out two separate loans. The CDC portion, which is affiliated with the SBA, is subject to the SBA loan risk guidelines, but the chunk of capital that comes from the bank is not. Banks may charge their own interest rates for their piece of the SBA loan — while the CDC is restricted to fixed interest rates.

The 504/CDC SBA loan option is typically ideal for a minority of business owners who are looking for commercial real estate options (that you plan on occupying over half of), need to purchase equipment, or are looking to complete costly renovations. If your goal includes the acquisition of long-term machinery for manufacturing or production, the 504/CDC program can be an excellent vehicle to facilitate this investment.

The 504/CDC loan program also includes a refinancing program. Up to 85% of the refinanced loan amount must have been originally used for edible or major fixed assets. These proceeds can cover substantial investments like heavy machinery acquisition and can include the financing of eligible expenses under the umbrella of refinancing.

SBA CAPLines

Business owners looking for a business financing option like a revolving credit turn to SBA CAPLines. H3: SBA CAPLines

Business owners in search of a robust solution to stabilize their working capital often turn to SBA CAPLines. Recognized for their flexibility, SBA CAPLines are designed specifically to aid small businesses in managing cyclical or seasonal cash flow challenges through a revolving credit line. Ideal for those aiming to bolster their short-term financial health, this program can be a great asset in enhancing a business's cash flow, ensuring they can handle day-to-day operations with greater ease.

SBA Express Loans

The Small Business Administration wanted to find a quicker option to their traditional financing. SBA Express Loans resembles the standard 7(a) program in qualifications and purpose. It gives the same great opportunity, such as short-term working capital — but even faster. For businesses looking for a loan in days instead of months — SBA Express Loans are a great alternative.

This loan product is perhaps the most streamlined of all the SBA loans as that is what the Small Business Administration intended. This is of course, assuming that you have all of the qualifications and documentation ready to go. The right lenders, such as your friends here at AdvancePoint Capital, can help you obtain SBA express loans in just days instead of weeks.

SBA Community Advantage

The Small Business Administration designed this loan specifically for businesses in underserved markets and a great option for newer companies, those in risky industries, and those owned by women, minorities, and even veterans. This is a pilot program, which means it is being operated for a limited time. However, it could be adopted into the full suite of SBA loan programs over time. So far, it’s expected to be extended until September 30, 2022. These are smaller loan amounts up to a maximum loan amount of $250,000 with interest rates of around 7% to 9%.

SBA Export Working Capital Program

Many banks do not offer working capital loans or advances for a small business that has export orders or receivables — nor do they offer letters of credit. Businesses that rely on this type of capital for their export sales may find their options limited. The Small Business Administration created this program to offer a 90% guarantee on export loans as a credit enhancement. This loan comes from a network of SBA Senior International Credit Officers who know the ins and outs of the trade finance marketplace. These can be both standard-term loans or short-term standard loans of up to $5 million. This program also offers an Export Express option, which gives a faster turnaround and streamlined process for obtaining the loan for you.

SBA Economic Injury Disaster Loans (EIDL) and Loan Advance

Disasters can cause many small businesses hardship, which is why the Small Business Administration is granting Economic Injury Disaster Loans & advances of up to a maximum loan amount of $5 million — with a $10,000 advance. These SBA-guaranteed loans are designed to offer economic relief for those businesses affected and losing revenue due to a declared disaster — and are for expenses such as operational costs and payroll. The advance amount is determined by the number of employees, at $1,000 per employee, up to a $10k maximum. These loans do not have to be repaid and require no approval or maximum maturity date. However, the amount of the advance will be deducted from the total loan eligibility. With attractive loan terms with low-interest rates, low loan fees, and terms as long as 30 years — the EIDL program has an automatic one-year deferral on payment. It should be noted that interest rates will increase over time if payment is deferred.

How to Apply for an SBA-backed Loan?

First, find a participating SBA lender because you will need help to apply for an SBA loan because it's a difficult application process. Some application processes are simple and fast. That is definitely not the case with an SBA loan. The application is lengthy, the documentation required is thorough, and if you miss anything, you have to start over again. Depending on which loans you’re looking at, interest rates and terms may vary. To be sure you include all of the pieces that the SBA requires, here is a checklist of the areas that are considered by the SBA when your application is in the process of getting approved:

- Your company must be physically located in the U.S.

- Your company needs to operate legally and be officially registered as a for-profit

- As the owner, you must have invested your own equity (time or money) into the business.

- You must have exhausted all other financing options and are unable to receive capital from other financial lenders.

- Small businesses are the only size that qualifies, and that size is dependent on the industry.

Down Payment for a Small Business Administration Loan

Two SBA loan types require a down payment. Both the SBA 7(a) and CDC/504 loan programs require a down payment equal to 10% of the total loan amount. Other types of SBA loans don’t require a down payment but are more difficult to obtain.

Relative to other loan options, SBA loans have some of the lowest costs on the market. This is especially true for those looking to purchase real estate, buy another business, or make necessary renovations for their business. If you’re looking to obtain business loans and you decide that an SBA loan is right for you, be prepared to provide a down payment.

Amount and Use of Funds

You must determine how much you are looking for, how you came up with that exact amount, and describe the use of the money needed for the business. Remember, it must be for a business purpose. Spreadsheets are a great way to show each section of your funding needs and, using the formulas provided, ensure that your numbers are accurate.

Credit History

To put it simply, you MUST have a strong personal credit history for the Small Business Administration to consider you for approval. SBA loans are not for those struggling with poor credit scores, so before you go through the arduous approval process — make sure that your personal credit history is sound.

Financial Statements and/or Projections

Depending on the type of SBA loans or program you are applying for, you will either have to provide financial projections for a start-up business or a business and personal financial statement like business tax returns, Profit and Loss, or balance sheets for established businesses.

Collateral

Most lenders offering SBA loans require other assets that you must put up as collateral, such as a home, financial accounts, inventory, or other property you own. This is not required for every loan, but it may come up in the application process and you should be prepared for it.

Industry Experience

It is not required that you have industry experience, but it is helpful if you and/or your management have experience in the field. The Small Business Administration wants to know that their money is going toward someone who knows what they are doing and has a good chance of success.

Whether you’re looking to buy real estate, pay staff, or even purchase another business — SBA loans have some great options to consider with terms upwards of 25 years for some products. The Small Business Administration helps provide loans for businesses that need it most with some of the most affordable interest rates on the market. Lenders and borrowers can both rest easy with the guarantees associated with an SBA loan.

It’s important to know that getting an SBA loan isn’t an easy process. A poor credit score can hinder your ability to receive SBA loans. However, a great credit score doesn’t equate to approval. Even with all of these pieces included in your application package, there is still no guarantee that you will get approved. However, knowing ahead of time what is required and taking the time to complete each section thoroughly and carefully will help reduce rejections due to incomplete sections and can speed up your approval.

Borrowers who need access to speedy cash have other avenues available to them that won’t require the thorough application process and a long wait for approval that an SBA loan requires. So if you are looking for fast business financing, check with AdvancePoint Capital to see which programs will work better for your needs.

The fast, convenient and straightforward way to get the money you need for your business – now!

Get Your Quote Today by filling out our simple form.