The data shows there hasn’t been a better time to be a small business owner in the United States in over a decade. Over 58.9 million Americans are employed by small businesses, comprising nearly half the entire private-sector workforce.

Want to learn more about the strength of the US small business economy? Below, we’ve compiled the latest economic research so you can make better business decisions in 2024.

US Small Businesses at a Glance

1. How many small businesses are there?

According to the head of the US Small Business Administration (SBA), over 30 million small businesses were driving the US economy in 2018. Perhaps what’s most startingly about this statistic is that these businesses make up roughly 99 percent of all businesses and 54 percent of all sales in the country.

2. How long do small businesses last?

The latest research indicates that two-thirds of American small businesses make it to the two-year mark. Beyond that, about half of all small businesses survive to the five-year mark, and only 33 percent last for 10 years or more.

3. How many small businesses are created every month?

Nearly 550,000 new small businesses launch every month in the United States. However, a near-equal number of businesses close their doors every month as well.

4. How many small businesses are sole proprietorships?

Almost one-third of all small businesses in the United States are sole proprietorships. In other words, they have only one employer who also owns the company. Most of these sole proprietorships are freelancers and independent contractors who work in the professional services industry.

According to Forbes, about 19.4 million nonemployer businesses are incorporated as sole proprietorships in the US. By contrast, 1.4 million are corporations, and another 1.6 million are partnerships.

5. What share of small business owners are women and minorities?

Of the 30 million or so small businesses in the United States, approximately 13 percent are owned and operated by a member of a visible minority group. Nearly one-third (or 31 percent) of small businesses are owned by women.

6. Why are small businesses failing?

A recent study indicates that 82 percent of small businesses fail due to cash flow shortages. It’s important for business owners in 2020 to remember that sales do not necessarily result in cash. All business owners must exercise proper cash management strategies to ensure they have enough in the bank to cover operational costs.

Small Businesses and Technology

7. How often will B2B workers use mobile devices in 2020?

Recent data suggests that in 2020, the average business-to-business (B2B) worker will increase their mobile device usage from two to three hours daily.

Although this may seem insignificant to some business owners, savvy small business leaders would do well to capitalize on this growing trend. Transitioning toward mobile-oriented marketing funnels and mobile applications would help businesses tap into this growing market.

8. Are small businesses investing in social media?

Small business owners are investing heavily in social media, and experts predict that the trend will continue in 2020 and the proceeding decade. At present, about 61 percent of small business owners are investing in social media marketing to help expand their brand and reach new customers.

9. Are all small businesses digitally engaged?

As we enter the new decade, a surprising number of American small businesses are still unplugged from the digital world. A study by Deloitte found that approximately 23 percent of small business owners claim that digital tools are “not relevant for their business” or “not effective” for their business’s growth.

In other words, there is considerable growth potential in migrating small businesses to digital platforms. Small businesses have room to grow on the digital front, whether it’s a digital content strategy, social media marketing, or a search engine optimization (SEO) overhaul.

10. What is the main barrier to digital adoption by small business owners?

A study by Deloitte found one prevailing technological barrier that separates small business owners from adopting a digital strategy. Deloitte’s researchers found that more must be done to quell the “privacy and security concerns” of business owners online.

Earnings and Growth

11. How much revenue do nonemployer businesses make in the US?

Data collected by the US Department of Commerce indicates that only 7.2% of all nonemployer businesses in the country generate between $100 and $250 thousand annually in revenue. Below, we’ve listed the revenue brackets compiled by the recent Department of Commerce study for the 2017 fiscal year.

| Revenue / Year | Percent | Establishments |

|---|---|---|

| $989.6 Billion | 100% | 22,491,080 |

| Less than $5K | 24.4% | 5,492,587 |

| $5K-10K | 16.9% | 3,795,785 |

| $10K - $25K | 25.3% | 5,689,588 |

| $25K - $50K | 13.5% | 3,029,809 |

| $50K - 100K | 9.6% | 2,151,075 |

| $100K $250K | 7.2% | 1,609,507 |

| $250K - 500K | 2.2% | 484,479 |

| $500K - $1M | 0.9% | 209,415 |

| $1M - 2.5M | 0.1% | 26,744 |

| $2.5M - $5M | 0.0% | 1,723 |

| $5M or more | 0.0% | 368 |

12. How many jobs have small businesses created?

In 2018, small businesses created approximately 1.9 million jobs. Compared to the year prior, companies with 20 employees or fewer experienced the largest growth by adding 1.1 million jobs. By contrast, companies with 499 or fewer employees added only 387 thousand jobs.

13. How much revenue do small businesses generate on average?

A 2016 Federal Reserve Bank study reported that 45 percent of all nonemployer businesses generate revenues of $25 thousand annually or less. The average annual sales for the United State’s nearly 25 million nonemployer businesses is $46,900. Therefore, only a small minority of businesses boast high annual sales or earnings.

14. What is the average household income of small business owners?

The household income of small business owners includes the owner’s gross salary, profits, and non-business income. A 2018 Payscale report found that small business owners median salary in the US is just above $59,000. Only 31 percent of business owners have a household income of $100,000 or more, whereas 35 percent have an income between $50,001 and $100,000.

Small Businesses and Credit

15. How much do small businesses borrow?

Under the Community Reinvestment Act, the fiscal year 2016 saw 5.7 million loans to small businesses worth $100,000 or less in the United States. Combined, these loans' total value amounts to over $82 billion.

16. What is the approval rate for small business loans?

The most recent data from the US SBA’s annual reports indicate that 29 percent of all minority-owned small businesses and 57 percent of white-owned businesses are approved for an SBA 7(a) loan. Currently, the SBA 7(a) loan remains the most popular debt financing option among American small business owners with good credit.

Readers should remember that the average SBA 7(a) loan size is nearly $400 thousand. Therefore, SBA 7(a) loans may not be a small business's most responsible financing option.

17. What is the approval rate for non-SBA loans?

US small businesses that seek loan financing options outside of the SBA face better odds of getting approved. For instance, American institutional lenders approved over 62 percent of all loan requests from small businesses, credit unions approved 42 percent, and alternative lenders approved over 60 percent.

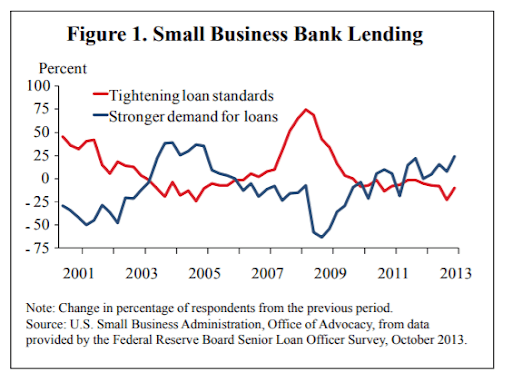

In the 2020s, we can expect it to become more difficult for small business owners to acquire startup funding. Over the past decade, an economic trend has emerged in which the demand for loans is becoming stronger while the standards to acquire one are rising. The effect of this trend is that lenders and banks are becoming more stringent with their lending criteria.

Source: SBA Office of Advocacy

18. How long does it take to get approved for a small business loan?

The average response time for a non-SBA short-term small business loan is fewer than 10 days. However, some alternative small business lenders can review and respond to requests within 24 hours of receipt.

19. How many small businesses receive the funding they need?

Unfortunately, some American small business owners cannot receive the funding they need to operate their businesses. According to a recent NSBA survey, 27 percent of business owners claim they could not receive the business funding necessary to finance their operations.

Small Businesses and Taxes

20. What do small businesses pay in taxes?

Sole proprietorships pay the lowest effective tax rate for businesses in the United States. According to the SBA Office of Advocacy, these companies paid only 15.1 percent in 2013 as their effective tax rate. For comparison’s sake, S-corporations made more than twice that on average during the same tax year.

| Legal Form of Business Ownership | Effective Tax Rate (Percent) |

|---|---|

| Non-farm sole proprietorship | 15.1 |

| Partnership | 29.4 |

| S Corporation | 31.6 |

| C Corporation | 17.8 |

For those unaware, the effective tax rate refers to one’s tax rate as a share of their net profit. The effective tax rate often provides a more holistic and accurate view of one’s tax burden than the marginal tax rate, which is the tax owed on the last dollar earned.

21. What are the criteria to qualify as a nonemployer business?

To qualify as a nonemployer business, you must accrue no less than $1,000 in business receipts annually and be subject to federal income taxes. Almost 75 percent of all American small businesses are nonemployer businesses.

22. How does the Tax Cuts and Jobs Act affect small business owners?

The Tax Cuts and Jobs Act tax reform legislation passed in December 2017 brings important changes to the tax code that are relevant for small business owners. Since coming into effect in 2018, small business owners receive a 20 percent tax deduction on qualified business income if they are a “pass-through” entity.

Pass-through entities in the United States include S-corporations, sole proprietorships, and partnerships. For the 2018 tax year, over 14 million income tax returns claimed this deduction, according to data from the Internal Revenue Service (IRS).

Small Businesses: Successes and Failures

23. At what age do most small business owners succeed?

There is no empirical data indicating at what age a small business owner or entrepreneur is most likely to succeed. However, a study by the US Census Bureau and the Massachusetts Institute of Technology found that the average 40-year-old is over twice as likely to find a successful startup business as someone 25.

24. What are the issues holding small business owners back the most?

An August 2019 study of American small business owners by the National Federation of Independent Businesses (NFIB) found three main issues holding business owners back from success. The problems that respondents cited the most were:

- Pervasive government regulations (13%)

- High taxes (15%)

- Difficulty finding qualified workers (25%)

Unless significant policy reforms make headway in the coming months, we can expect the abovementioned problems to persist throughout 2020 and the coming years.

25. Why do startups and small businesses fail?

There are many reasons why small businesses fail while others prosper. However, a lack of market need is the most commonly-cited cause of failure for a small business. Currently, 42 percent of all failed small business owners cite a lack of demand in the market as the primary reason behind their demise.

26. How much startup financing is required to launch a business successfully?

The capital requirements of a small business vary from industry to industry. However, a Wells Fargo Small Business Index study found that the average sum of startup capital in the US is $10,000. Readers should note that some studies indicate that you may require several times more—again, the exact figure will vary by industry.

27. Can small business owners fill their job openings?

In the 2019 Annual Report of the Office of Economic Research (OER), the agency of the SBA found that many business owners are having a hard time finding workers. The OER survey found that the percentage of small business owners in the US unable to fill their job openings has sharply risen from eight percent in 2009 to 38 percent in August 2019.

There are many possible explanations behind the current labor shortage. However, the most obvious explanation is that the unemployment rate (3.9%) is lower than the job openings rate (4.4%). Therefore, there is a surplus of jobs available to workers.