What is a Factor Rate?

A factor rate (Money Factor) is a fixed cost charged for alternative business lending or business financing. This rate is often used to determine the borrowing costs associated with a loan, including admin fees and financing repayment amounts. Therefore, a factor rate is critical in understanding the total cost of your financing. Remember, to calculate the overall cost, you would subtract the original advance amount from the total repayment amount.

Similarly, a loan's APR uses the loan's interest rate, repayment term, and certain lender fees such as an admin fee to provide a clearer picture of the annual financing costs. It can be seen that both factor rates and APRs play intricate roles in comprehending the complex nature of borrowing costs.

Factor rates are not interest rates or an annual percentage rate (APR.) Unlike accrued rates that have compounding interest, factor rates are expressed as a fixed fee multiplier whereby all of the cost is charged to the principal when the business loan or advance is originated.

How Does a Factor Rate Work and How Is the Financing Calculated?

So what is a factor rate? In essence, it's a tool used by lenders to help establish the total payback amount on a short-term business loan, and it can often vary based on different repayment options. However, to truly grasp the full implications of a factor rate, one must take into account not only these repayment options, but the loan's repayment term and interest rate as well.

For example:

Principal Loan Amount: $10,000

Factor Rate: 1.25

Payback Amount: $12,500

Repayment Periods: Vary

In this example, you multiply the amount borrowed by the factor and get the total payback you owe ($10,000 x 1.25 + $12,500). The total cost for the loan was $2,500 ($12,500 payback – $10,000 loan amount+ $2,500), which is the difference between the amount funded and the amount you are responsible for paying back.

It's this intricate combination which will ultimately define the Annual Percentage Rate (APR) of your financing. The APR, which also includes additional lender fees, is a crucial metric, as it provides a clear picture of your financing's yearly total cost. It's beneficial to remember, a useful strategy to calculating the total cost of your financing is subtracting the original advance from the total repayment, e.g., $70,000 - $50,000 = $20,000. Keep in mind, your Account Executive at Lendio is always on standby to assist with any enquiry about your financing repayment, so don't hesitate to reach out!

Interest Rate vs. Factor Rate Financing vs. APR

What is an interest rate?

Interest rates are defined as the portion of the loan of the amount loaned, which a lender charges to the borrower, normally expressed as an APR. It's important to note that in the case of APR lenders, some fees may not be included in the APR as there is some regulatory leeway for lenders reporting every single fee. The rate is compounded daily, meaning you are only charged based on the current principal.

Loan factor rates, as described above, are fixed costs and not compounded daily, which means that you are responsible for the full cost.

The difference between Interest Rates and Factor Rates

The clear difference between an APR loan and a factor loan is that you are responsible for the full payback on the factor rate whether you payoff early or not while an APR loan you are only paying interest charges on your remaining balance at the time of early payoff. This reflects the borrowing costs for each option differently. The factor rate, a decimal figure, effectively determines the total financing repayment amount, remaining constant regardless of how early or late payments are made. This feature adds a certain predictability, which can influence your overall cost of borrowing. Unlike this, an APR loan's interest accrues over time, hence, if you clear it earlier, you end up paying less interest; this is an important consideration when calculating your financing repayment.

Also, remember that the frequency of your payments has an influence on APR calculations due to the timing of the collection of the money against the principal.

Factor Rate vs Interest Rate

- The rate being a decimal figure, the accuracy in predicting your payback total is its significant upside * The rate is expressed as a percentage

- The difference from funding amount & payback amount stays steady, reflecting stable borrowing costs * Applied to outstanding balance, affecting the overall financing repayment

- Common with Merchant Cash Advance, Short term loans, Invoice financing * Primarily used for Traditional loans & lines of credit. The choice between these largely depends on the type of financial service required.

Pros and Cons of Factor Rate Versus Interest Rate Loans

The choice of factor rate vs. Interest rate loans is not a light decision, heavily influenced by product specificity, borrowing costs, and several other key takeaways such as alternative funding availability, risk assessment, and your business' creditworthiness. The optimal choice typically aligns with the product that satisfies your needs at the least expense and most attractive terms, considering the individual criteria implemented by the funding corporation and its repayment options.

Pro's of Factor Rates

- Business fundings with factor rates generally have higher approval rates than interest rate loans due to more relaxed criteria in comparison to traditional lenders.

- The application and approval processes are notably faster (usually the same day) vs. interest rate products

- One of the key takeaways is the transparency of the total cost of borrowing known upfront, providing a closer approximation to the actual borrowing costs.

Con's of Factor Rates

- There's an incremental increase in costs and fees vs. interest rate products, effectively increasing the overall financing repayment.

- Unlike with interest rate loans or lines of credit, there's no financial advantage to paying off a factor rate product early, often leading to higher borrowing costs.

- Key takeaway: Factor rate products generally come with tighter repayment schedules than interest rate products, dependent on their respective criteria, impacting financing repayment strategies.

How Lenders Determine Your Factor Rate

In determining and calculating factor rates, business lenders and/or funders look at the following characteristics:

- Application- The business profile/information and personal information of business owner. Each of these details about the business or proprietor has the potential to meet the stringent lending criteria typical of alternative lenders, swaying the factor rate, and consequently, the borrowing costs.

- Personal Credit history (credit score) of the business owner- Personal credit impacts the factor rate as it helps lenders to gauge your creditworthiness. Your personal financial history and credit rating can significantly influence the terms of financing offered to you, especially the borrowing costs and repayment term.

- Business Credit- Lenders scrutinize the business's credit history and its financial records' accuracy to determine the financing repayment terms, which could ultimately affect the factor rate.

- Industry- Industries have inherent risk levels that can affect the financing terms, including the repayment term. Some industries may pose more risk than others, leading to variations in the factor rate.

- Time in business- The longer your business has been running, the lower the credit risk, which favorably influences your repayment term and, consequently, your factor rate.

- Bank Statements (Cash Flow Health)- The cash flow consistency and average daily debit and credit card sales of a business are critical indicators of financial stability, influence borrowing costs, and ultimately determine the factor rate.

- Average monthly deposits- An assessment of your business's debit and credit card transactions complements the frequency and total value of deposits per month in deciding the factor rate, thereby impacting financing repayment.

- Financial Statements (if applicable): Tax returns, if required, influence the factor rate through profit & loss evaluations, playing a pivotal role in agreeing on borrowing costs and setting up a fair repayment term.

Remember, the factor rate is a fixed rate that's multiplied by the amount you receive to determine the repayment amount, which stays the same no matter how long you take to repayment term. Moreover, the factor rate may fluctuate based on the lending company's policies, their risk appetite, and the weightings they use for decision making.

How Do You Convert a Factor Rate into an APR (Annualized Interest Rate)?

Here is the 4 step process:

Step #1: Calculate Total Payback

First, we calculate the interest payable by multiplying the loan amount by the factor rate and calculating the difference. The use of a factor rate, rather than a traditional interest rate, eases this process as it allows for straightforward calculations without the addition of compounding interest. Factor rates detail exactly what will be paid on top of the principal, eliminating any hidden fees.

Here's an example:

Advance Amount x Factor Rate = Total Payback Amount.

So, in this case, $25,000 x 1.25 = $31,250.

This encapsulation of the entire payment plan without any compound interest is indeed a significant takeaway.

Step #2: Calculate the Total Cost

Calculate the total cost of the advance by subtracting the total payback by the advance amount

Takeaway the Factor Rate and Compute the Total Cost:

To draw an accurate financial picture, subtract the total payback amount from the advance amount. This computation gives you the straightforward cost of your financial advance. Remember, in your calculation, it's worth considering lender fees as well as your given loan's APR, as some costs may not be upfront.

Think of it this way:

Total Payback Amount - Advance Amount = Total Cost

Example: $31,250 (including potential lender fees) - $25,000 = $6,250

Step #3: Calculate the Decimal Cost

Then divide the interest total cost by the funding amount to get a decimal and then multiply this decimal by 365. Then divide this by the term (in days) to determine the annualized interest rate.

Example: Total Cost divided by Funding Amount = Decimal Cost

$6,250 divided by $25,000 = .25

Step #4: Calculate the Annualized Interest Rate (APR)

To calculate the APR, use the frequency of repayments as how frequently interest on the loan compounds (daily, weekly, fortnightly, or monthly). Then calculate the number of payments, repayment amount, and interest per frequency to build an amortization schedule to calculate the effective APR.

Calculate the fees and charges payable over a year in days. This is then divided by the loan amount. And then multiplied by. And then divided by the term in days. This figure is added to the effective APR to give us our final effective APR.

Example: .25 x 365 = 91.25

X divided by expected repayment period ( in days (this will be estimated) x 100 = annualized interest rate

Example: 91.25 divided by 120 days (estimated) x 100 = 76.04% Annualized Interest Rate (APR)

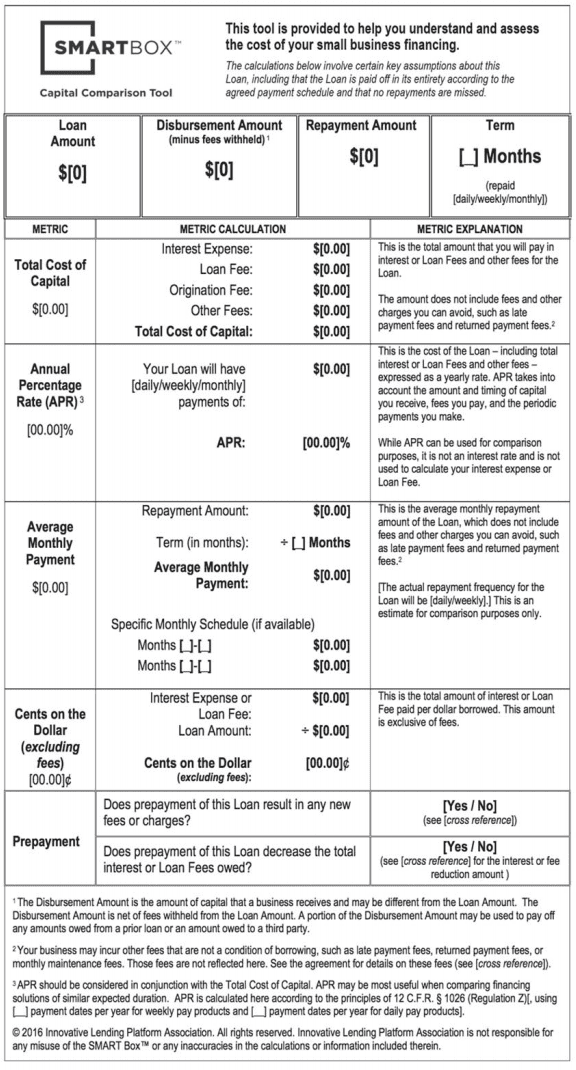

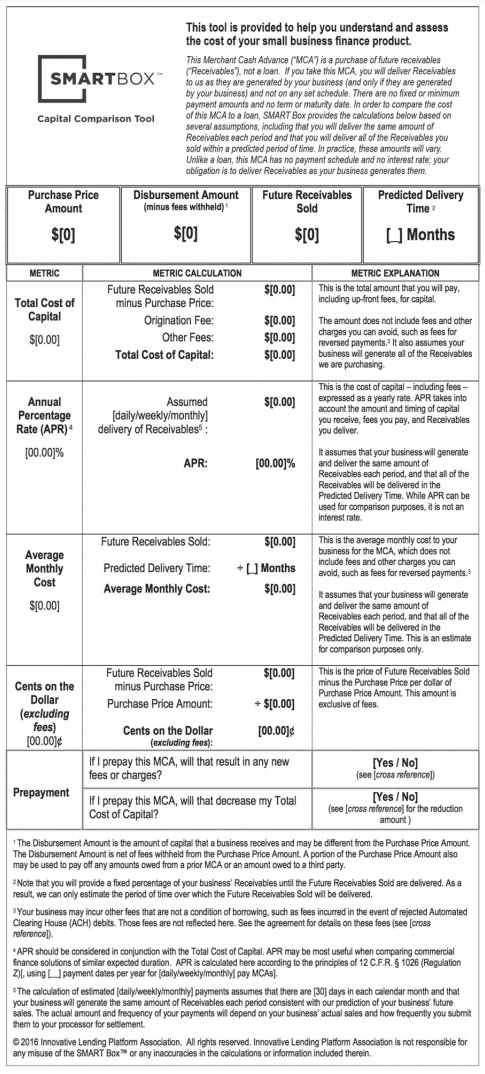

Did I confuse you enough? Well don't worry, a Smartbox disclosure is usually available to calculate this conversion for you and should be provided by the business funder or lender when acquiring business financing and trying to determine finance charges.

Samples of “Smart Box Disclosures”

What Types of Business Financing Products Use Factor Rates?

Factor rates are offered usually by alternative business lending for higher risk borrowers unlike interest rates which are typically dedicated for lower risk borrowers. The most common alternative business financing products that use a factor rate to calculate cost of borrowing money are merchant cash advances, short term business financing and invoice factoring.

Merchant Cash Advance

A merchant cash advance is a revenue- based business funding option that is a purchase of future receivables at a discount from a merchant in exchange for a lump sum of money (advance) upfront, paid back by the funder taking a set percentage of future sales either by a split of credit card sales or total deposits, until the discounted price is paid back in full. Here, the sales are essential not only for the merchant cash advance companies but also form an integral part of an array of merchant funding products available in the market. Indeed, the repayment of MCAs is directly tied to these future earnings.

Merchant Cash Advances (MCAs), invariably offered by merchant cash advance providers, represent a viable alternative to conventional loans. These are largely intertwined with your business' credit and debit card transactions - a distinguishing feature of many merchant funding products.

- The factor rates applicable to MCAs can oscillate between 1.15% to 1.48%, and are often influenced by the business's qualification and risk profile. It's crucial to note that these rates indirectly reflect borrowing costs, and can vary considerably depending on how often the interest is compounded.

- MCAs are more than just loans. They represent a unique sort of merchant funding product offered by various merchant cash providers who primarily purchase a percentage of your business's anticipated debit card revenues.

- These cash advances are repaid to the merchant cash provider as a predetermined portion of your everyday or weekly credit and debit card sales - one of the flexible repayment options available with MCAs.

- Remember, the overall borrowing costs may increase with the possibility of additional fees. Be sure to fully comprehend these terms before entering into an agreement to dodge any unintended financial implications.

Short Term Business Loan

Short-term business loans are higher risk business term loans that offer a lump sum under fixed terms, fixed factor rate with a fixed payment, typically weekly or daily. These are distinctive lending products offered by various financing companies, and represent a common choice among the many business financing options available.

- This type of financing , particularly popular within the small business sphere, carries factor rates ranging from 1.13% to 1.48%, depending on the risk associated with the application. Such factor rates are typically used for lending products that have no fixed term, meaning you can pay them back at your own convenience and your borrowing costs will remain steady.

- Additional fees may not be included in the factor rate, and these, along with differences in repayment options, can lead to varying total payback amounts.

- An estimated APR can help you understand the cost of a short term business loan that uses a factor rate and additional fees, thus painting a clear picture of the true borrowing costs when you secure this kind of business financing.

- On one end of the spectrum, options like merchant cash advances, found in most short-term business financing options, can potentially be the priciest with APRs soaring as high as 350%.

Invoice Financing (Factoring)

Invoice financing, also know as invoice factoring, is a funder who purchases invoices at time of issuance from an issuer (merchant) at a discount. This strategy is an essential merchant funding product, where borrowing costs are linked directly to invoice values. The purchaser provides a lump sum advance, less a deposit from 10 to 20 percent that is returned once invoice is paid under the normal terms on the invoice, less a factor rate. Factor rate costs typically range between 0.50 to 5% of the face value of the invoice, meaning the repayment options can vary, capturing the nuances of borrowing costs too. Extra fees such as a monthly process fee based on volume of invoices may also be applicable.

In your agreement, you might be contractually required to factor a set volume, establishing a regular but flexible repayment scheme. Not only this, but you may be required to factor invoices monthly for a term that can be 6 months up to 3 years, bringing about a long-term influence on borrowing costs. Due to the potential variances in payback amounts among factor rates, and other repayment options, ensuring you are well-aware of business loan conditions is crucial before signing.

Personal Loans

Private personal loans used for business purposes often have factor costs based on money borrowed as well for short term funding. H3: Personal Loans

Private personal loans used for business purposes often have factor costs based on the borrowing costs as well. These costs, typically attached to short-term funding, represent a significant aspect of the total payback amount. It's strongly recommended to comprehend all repayment options and conditions tied to your loan before proceeding.

Frequently Asked Questions

How do you calculate a Factor Rate?

The calculation of a factor rate involves isolating the total payback amount from the sum borrowed. This process helps to accurately determine the factor cost.

For example, if the payback amount is $13,000 whilst the funded amount is $10,000, dividing the two would yield a 1.30 factor rate.

Which is better a Factor Rate vs. Interest Rate?

An interest rate—viewed as a daily rolling cost—proves less expensive than factor rates. This can result in great savings if the total sum is repaid earlier than scheduled. While factor rates offer a flat rate of cost, they generally surpass interest rates and usually do not offer significant discounts for early payoff.

Are Factor Rates Always Higher Than Interest Rates?

Factor rates are indeed typically higher than interest rates—especially when dealing with business funding products. This is a critical factor to consider for businesses seeking loans, particularly those with questionable credit standings as observed in our website page, 'Business Loan Options For Bad Credit'.

What factors determine the Interest Rate?

Numerous elements come into play when deciding the prevailing interest rate. These variables can include the unique features of the product, the qualifications of the applicant, as well as current market conditions.

Is Alternative Funding with Factor Rates Right For You and Your Business?

As in any small business financing option, you need to balance the cost of a business financing product verses the benefit of acquiring financing. The task becomes more critical when sifting through the wide array of merchant funding products. The selection of a suitable merchant cash provider for your unique needs is central to this process. It necessitates a deep understanding of financing terms, calculating the amount you're seeking, and grasping how your chosen business financing alternatives—including those from merchant cash advance providers—will sketch your cash flow.

In this scenario, the "need" for funding, coupled with potential savings, routinely governs the decision whether to finance or not. For instance, if the injection of capital offers immense benefit to your business and far outweighs the cost of financing, a product featuring a factor rate might suit you. Factor rates are characteristic of short-term business financing options like merchant cash advances and working capital loans, which are considered riskier but more flexible lending products without fixed term.

However, bear in mind that this is a suitable choice only if it is the best product you qualify for according to your loan's annual percentage rate (APR)—a standard tool to evaluate and compare costs across lending products. Resist the urge to secure business loans if the expenses surpass the benefits, or if early repayment penalties impede your savings.

Always ensure that you have extensively explored all financing terms and choices, including engaging with multiple business finance advisers or advertisers, before you contend with a funding option featuring a factor rate. This will certify that it fits your needs and qualifications.

The Bottom Line About Factor Rates

Remember to ask for clear disclosures (like the SmartBox or truth in lending) or State specific disclosures so you understand the total cost of the financing and know that early payment is not going to afford you a discount on total costs on the interest rate factor, unlike a principal and interest loan unless the lender or funder offers some type of early pay discount for paying the factor rate loan off early. It's always important to ensure the financial information provided is transparent and comprehensible.

Factor rates are not necessarily bad, as they allow business lenders and funders to offer money to business owners that would not typically get approved for business financing due to risk factors similar to those seen with merchant cash advances. Factor rates have opened the doors to many innovative business funding products that did not exist in years past. This cost calculation plays an important role in today's business lending environment.