What Is American Express Business Line of Credit?

An American Express Business Line of Credit is a financial product designed to help businesses manage cash flow and handle unexpected expenses more efficiently.

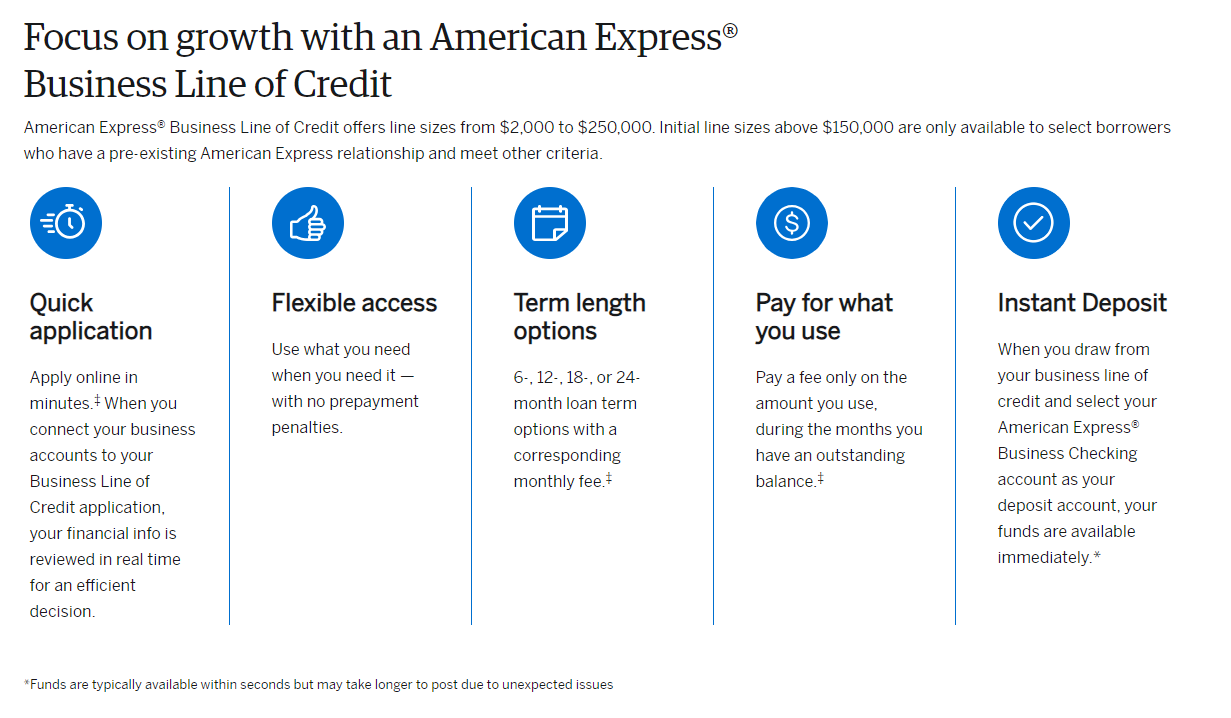

Understanding credit line availability is crucial for businesses aiming for growth, and the American Express Business Line of Credit provides just that. Unlike traditional loans, this line of credit allows businesses to borrow up to a pre-approved limit and only pay interest on the amount utilized. This means the borrowing process is more flexible and suited for businesses that need quick access to funds without the commitment of a long-term loan.

Moreover, by using tools like the business loan calculator and keeping in mind loan eligibility requirements, businesses can efficiently plan for their borrowing needs. American Express emphasizes transparent borrowing costs and recommends a credit score amex of at least 660 for applicants to qualify for their credit offerings.

One of the standout features of the American Express Business Line of Credit is its seamless integration with other Amex business services, providing a comprehensive financial toolkit for cardholders. Businesses can easily manage their borrowing within the same platform they use for everyday transactions, simplifying financial management and potentially reaping benefits and rewards.

Overall, the American Express Business Line of Credit is a versatile and accessible option for businesses looking to enhance liquidity and propel growth without the immediate pressures of repayment.

How does the American Express Business Line of Credit work?

The American Express Business Line of Credit operates as a revolving credit facility, providing businesses with the coveted flexibility to draw funds up to a predetermined limit and repay them according to an established repayment schedule.

Once approved, borrowers can enjoy the freedom of installment loans within their credit limit, paying interest only on the actual amount borrowed. This feature is particularly advantageous for businesses managing fluctuations in cash flow, as it allows access to funds during peak times or to cover unforeseen expenses without the hassle of applying for a new loan. Payments made on the borrowed amount replenish the available credit, thus enabling continuous accessibility, a key factor for maintaining a healthy cash flow and operations.

Amex Business Blueprint particularly emphasizes accessibility and efficiency, offering rapid application processing, with the potential for funding in as little as three business days, and detailed monthly statements for improved financial tracking. Importantly, as a testament to their support for businesses, Amex doesn’t impose repayment penalties, allowing the flexibility to pay off the balance before the term expires without extra costs. Additionally, the variable interest rates reflect market conditions and the business's creditworthiness, ensuring competitive terms.

Crucially, ongoing payments are reported to credit bureaus, helping businesses build a solid credit profile with agencies like Dun & Bradstreet, Equifax, and Experian. By integrating the American Express Business Line of Credit with other American Express business tools and rewards, companies can extend the utility of their credit facility beyond mere expense management, moving towards strategic investment and growth. This exemplifies a holistic approach to financial resources, essential for savvy businesses aiming to scale up and thrive.

Business Line of Credit Key Features

Understanding the critical aspects of a business line of credit can help entrepreneurs manage their business finances more effectively. Firstly, one of the attractive features is that there is often no requirement for an origination fee, which can add up to significant savings. This is a sharp contrast with some loan offerings where such fees can increase the initial cost of obtaining credit. Moreover, the flexibility of drawing funds as needed rather than receiving a lump sum up front allows for better cash flow management. Each withdrawal is viewed as a separate loan, and thanks to robust repayment schedules, many lenders offer the option to repay early without incurring prepayment penalties. For those minded to watch their fico credit score, it's good to know that the credit pros in this arena often look for a minimum FICO score of 660 at the time of application, letting you assess your chances of approval beforehand.

| Business Line of Credit | Description |

| Credit Limit | Up to $250,000 |

| Repayment/Amortization | 6 months, 12 months, 18 months, 24 months |

| Starting Interest Rates | 3% to 9% for 6-months. 6% to 18% for 12-months. 9% to 27% for 18 months. 12% to 18% for 24-months |

| Payment Frequency | Monthly |

| Other Charges | Each repayment term has a specific minimum borrowing amount: $500 is the min. draw for 6-month term, $10,000 is the minimum for a 12-month term, and $20,000 is the minimum for 18 or 24 month. |

| Personal Guarantee | Yes, a personal guarantee is required for American Express Business Line of Credit. |

| Additional Fees | No Application Fee, No Annual Fee, No Monthly Maintenance Fee or Origination Fee |

| States Available for Funding | All States |

| Time to Fund | Funds hit bank account in same day to 24 hrs. |

Remember, while a business line of credit can offer convenient access to funds, it's important to understand the full terms and conditions, including any maintenance fees that might apply over time.

What are the Qualifications for American Express Business Line of Credit?

To qualify for an American Express Business Line of Credit, businesses must meet certain criteria that primarily assess their creditworthiness and financial stability. American Express typically evaluates several factors to determine eligibility and the amount of credit to offer.

This assessment ensures that only financially sound businesses can access the line of credit, thereby minimizing risk and fostering responsible borrowing.

- Minimum time in business 12 months: Amex prefers the business should be in operation longer than two years to demonstrate stability and reliability and receive best rates. However, to meet the eligibility requirements, businesses must have been operational for at least a year.

- Minimum Credit Score 660: A good to excellent credit score is crucial; this reflects the business’s ability to manage debt responsibly. To cater to a wide range of borrower requirements, American Express has set a minimum FICO score of at least 660, which is often more attainable for small business owners.

- Financial Statements: Recent financial statements are often required to assess the business’s health and cash flow capabilities.

- Revenue Requirements: Minimum annual revenue $36,000 ($3,000 in monthly revenue). Minimum annual revenue requirements are to ensure that the business has sufficient income to support debt repayment.

- Existing Financial Obligations: The company’s current debts and financial obligations are considered to ensure that adding a line of credit is feasible.

- Legal and Compliance Checks: The business must comply with relevant legal standards and have all necessary licenses in place. Obtaining approval from small business lenders like American Express also means your credit activities may be reported to business credit bureaus, aiding in building your business credit profile.

What Is American Express Business Line of Credit Interest Rates?

- 3% to 9% for 6-month

- 6% to 18% for 12-month

- 9% to 27% for 18-month

- 12% to 18% for 24-month

When considering these interest rates, it's vital to note that they serve as an approximation of the borrowing costs, reflecting the annual percentage rates (APRs) which give a comprehensive view of your annual borrowing expenses, including any fees. The interest rates for an American Express Business Line of Credit can vary significantly based on several key factors. These rates are competitive within the market and are designed to accommodate the diverse needs of different businesses. Major influences on these rates include:

- Creditworthiness: The better the credit score and credit history of the business, the more favorable the interest rate. Good creditworthiness can also play a significant role in comparing borrowing costs, especially when comparing options like Chase and American Express credit lines.

- Market Conditions: Interest rates can fluctuate based on the broader economic environment, including central bank policies and the prevailing APRs.

- Amount Borrowed: Higher credit limits might attract slightly lower interest rates due to economies of scale, impacting the overall borrowing costs.

- Repayment History: Businesses with a history of timely repayments may qualify for lower rates on subsequent borrowings, sometimes offering more attractive APRs.

- Business Financial Health: Stronger financial statements and higher revenue streams can lead to more favorable rates, as they suggest reduced risk to the lender.

- Duration of Credit Use: Shorter use of borrowed funds can sometimes attract higher interest rates compared to longer-term borrowing within the credit terms, as shorter terms often imply higher APRs.

Understanding these aspects can help businesses strategically plan their borrowing in a way that minimizes costs and aligns with their financial objectives.

What is the American Express Merchant Financing Fee Structure?

The fee structure for the American Express Business Line of Credit is designed to be transparent and straightforward, focusing on providing value while managing costs effectively for businesses.

- No Annual Fee: There is NO annual fee associated with maintaining the line of credit.

- Origination Fee: There is NO origination fee, charged when the line is first established.

- Late Payment Fee: If payments are not made on time, a late payment fee could be applied.

- Over-limit Fee: American Express DOES NOT allow the business to exceed the agreed credit limit.

- Renewal Fee: For the renewal of the credit line at the end of its term, there is NO fee to renew line.

- Prepayment: Additionally, businesses are free to make a prepayment or add a lump sum to their balance without worrying about prepayment penalties, maintaining financial flexibility.

What are the Pro's and Con's of American Express Business Line of Credit?

The American Express Business Line of Credit offers distinct advantages and some potential drawbacks that businesses should consider before applying. It provides a flexible funding option that can adjust to the dynamic financial needs of a business, promoting smoother cash flow management and operational fluidity. However, like any financial product, it also presents challenges that may not suit every business model.

Pros:

- Flexibility in Usage: Funds can be drawn as needed up to the credit limit, making it ideal for unforeseen expenses and seasonal fluctuations.

- Interest Only on Used Amount: Businesses pay interest only on the amount they actually use, which can be more cost-effective than traditional loans.

- Revolving Credit: As payments are made, the credit becomes available again for use without the need to reapply.

- Integration with Amex Services: Seamless integration with other American Express services and tools can enhance overall business financial management.

Cons:

- Variable Interest Rates: The interest rates can vary based on market conditions and the business’s financial state, potentially increasing costs unexpectedly.

- Credit Requirements: High credit standards can exclude some smaller businesses or startups from qualifying.

- Risk of Overleveraging: Easy access to credit can lead to overborrowing, which some businesses may find difficult to manage responsibly.

How to apply with American Express Business Line of Credit and What Documentation do You Need to Apply?

Applying for an American Express Business Line of Credit involves a streamlined process tailored to quickly assess a business's eligibility and needs. The application can typically be completed online through the American Express website, or by contacting their business services directly. Applicants must provide specific documentation that helps American Express evaluate their business's financial health and creditworthiness. This documentation is crucial for a smooth application process and ensures that the business meets American Express's lending criteria.

Application Steps:

- Online Application: Start by filling out an application on the American Express website or through their customer service. Follow the onscreen prompts to meticulously provide your application info.

- Personal and Business Information: American Express will request essential details about you and your business. By providing accurate application info, such as your name, home address, social security number, and phone number, as well as your business name, address, and phone number, you help streamline the process. They will also inquire about your business industry and require your business tax ID number, helping to minimize lengthy paperwork.

Required Documentation:

- Business Financial Statements: You will need to set up and sign into your American Express account. Next, link your business checking account along with any other relevant accounts to the American Express Business Blueprint™ platform.

- Tax Returns: Both business and personal tax returns MAY be required for the last two years for large credit limits.

- Proof of Business Registration: Documentation proving the business is legally registered and compliant with local regulations.

- Bank Statements: Recent bank statements to demonstrate the business’s current financial standing.

- Credit Report Authorization: Permission for American Express to hard-pull the personal and business's credit report.

- Ownership Verification: Documents that verify the identity and stake of the business owners.

How to manage your American Express Business Line of Credit account?

Managing your American Express Business Line of Credit through the Business Blueprint account is designed to be user-friendly and efficient, ensuring that business owners can focus on their core operations while easily overseeing their finances. This online platform allows users to access their credit line, monitor transactions, and manage repayments with just a few clicks. Regular use of the platform's features helps maintain a healthy credit line while optimizing financial strategies aligned with business goals.

Key Management Features:

- Dashboard Overview: Access a comprehensive view of your current balance, available credit, and recent transactions.

- Automatic Payments: Set up auto-pay to ensure timely payments and maintain credit health.

- Customizable Alerts: Receive notifications for due payments, credit limit changes, or other important account activities.

- Transaction Review: Regularly review transactions to monitor spending and identify any discrepancies.

- Financial Tools: Utilize built-in tools for forecasting and budgeting to better plan for future spending and repayments.

- Support Access: Easily reach customer support for any queries or issues regarding your account.

How Long does it take to fund with American Express Business Line of Credit?

The funding process for an American Express Business Line of Credit is designed to be swift and efficient, reflecting the needs of businesses for quick access to funds. Once approved, the funds from the line of credit are typically available almost immediately, allowing businesses to respond promptly to financial demands. This rapid access is a significant advantage for businesses that need to capitalize on immediate opportunities or address sudden financial shortfalls without the typical waiting periods associated with traditional loan processing.

Key Points About Funding Timeline:

- Quick Approval Process: Depending on the business's creditworthiness and completeness of the application, approval can occur within a few business days.

- Immediate Fund Access: Upon approval, funds are typically available for use almost instantly, which is crucial for urgent financial needs.

- Streamlined Online Access: Manage and access your funds through the American Express online portal or mobile app, making the process straightforward and user-friendly.

- Flexibility in Draw Amounts: Draw as little or as much as you need up to your credit limit without additional approval delays.

- Continuous Availability: As you repay the borrowed amount, your credit becomes available again, offering ongoing financial flexibility without needing to reapply.

How good is American Express Business Line of Credit Customer Service?

American Express is renowned for its strong customer service, and this reputation extends to its Business Line of Credit services as well. The company prioritizes responsive, helpful support tailored to the needs of business owners, ensuring that any inquiries or issues are addressed swiftly and effectively. Customers can expect a high level of support through various channels, which facilitates a smooth experience when managing their line of credit. This commitment to quality service is a key reason why many businesses choose American Express as their financial partner.

Highlights of American Express Business Line of Credit Customer Service:

- Multiple Support Channels: Access customer service via phone, email, or live chat, providing convenient options based on user preference.

- Dedicated Business Support: Specialized support teams are knowledgeable about business financial products, offering relevant and timely assistance.

- 24/7 Availability: Customer service is available around the clock, ensuring help is on hand whenever it's needed, regardless of time zone or hour.

- Resource-Rich Website: The American Express site offers extensive FAQs, guides, and tutorials to help businesses understand and manage their line of credit effectively.

- Personalized Assistance: Account managers are often available for businesses with complex needs or higher credit lines, providing more tailored support.

- Proactive Communication: American Express is proactive in communicating changes in terms and conditions, interest rates, and credit limit adjustments, keeping businesses well-informed.

What do I do if my business is declined by American Express Business Line of Credit?

If your business application is declined by American Express for a Business Line of Credit, it's important not to be discouraged as there are several steps you can take to understand the decision and improve your future chances. Initially, review the reasons provided by American Express for the decline, which can offer valuable insights into areas your business may need to strengthen. This feedback can help you address specific issues before reapplying or seeking other financial solutions.

Steps to Take if Declined:

- Request Detailed Feedback: Contact American Express to get more detailed explanations about the decline, which can help you pinpoint specific areas of improvement.

- Improve Credit Health: Work on enhancing your business's credit score by clearing outstanding debts and ensuring all bills and loans are paid on time.

- Review Financial Statements: Analyze and improve your financial statements to ensure they reflect a stable and profitable business.

- Explore Other Financial Products: Consider other American Express products that might be easier to qualify for, or explore credit options from different providers. Advancepoint Capital would be happy to look at the many business funding options available in the marketplace for you.

- Wait Before Reapplying: Give your business some time to improve its financial standing and address any issues highlighted by American Express before reapplying.

- Seek Professional Advice: Consult with a financial advisor to understand better the options available and strategies to bolster your business’s financial health.

American Express Business Line of Credit Reviews on Trust Pilot and Google

Trust Pilot Reviews

Amex Blueprint receives moderately positive feedback online, securing a 3.5-star rating out of 5 on Trustpilot after 6,738 reviews. I found that many users commend its straightforward application process. However, some express concerns about low borrowing limits and lackluster customer support. Additionally, it's worth noting that Amex Blueprint offers a variety of financial products, and a significant portion of the recent criticism seems to center around issues with its checking account services.

Google Reviews

In my exploration of Google reviews for the American Express Business Line of Credit, I've noticed a mixed spectrum of feedback. Many business owners praise the flexibility and reliability of the credit line, appreciating how it helps manage cash flow and unexpected expenses. On the flip side, some reviewers have expressed dissatisfaction with the customer service, mentioning difficulties in resolving issues and long wait times for assistance. This variety in experiences highlights the importance of weighing both the benefits and potential challenges when considering this financial tool for business needs.

Alternatives to the American Express® Business Line of Credit

When exploring alternatives to the American Express® Business Line of Credit, businesses have a variety of options, each with distinct terms and conditions to accommodate different financial needs. OnDeck, BlueVine, Headway Capital, Fundible, and Wells Fargo offer diverse financial products, varying primarily in credit limits, interest rates, term lengths, and eligibility criteria. For instance, OnDeck and BlueVine cater specifically to small businesses with relatively quick funding needs, often requiring less stringent time in business and revenue qualifications. Headway Capital and Fundible offer more flexibility with lower credit score requirements, making them accessible to a broader range of businesses. Meanwhile, Wells Fargo provides more traditional banking services with potentially higher credit limits and longer-term lengths, suitable for well-established businesses with strong financial histories.

Key Features of Each Alternative:

OnDeck:

- Credit Limits: Up to $250,000

- Interest Rates: Starting around 35% APR

- Term Lengths: Up to 24 months

- Time in Business Required: Minimum 1 year

- Minimum Annual Business Revenue: $100,000

- Minimum Personal Credit Score: 600

BlueVine:

- Credit Limits: Up to $250,000

- Interest Rates: As low as 4.8%

- Term Lengths: 6 to 12 months

- Time in Business Required: Minimum 6 months

- Minimum Annual Business Revenue: $100,000

- Minimum Personal Credit Score: 600

Headway Capital:

- Credit Limits: Up to $100,000

- Interest Rates: Varies widely, typically higher

- Term Lengths: Up to 24 months

- Time in Business Required: Minimum 6 months

- Minimum Annual Business Revenue: $50,000

- Minimum Personal Credit Score: 550

Fundible:

- Credit Limits: Typically varies based on lender

- Interest Rates: Varies by lender and financial product

- Term Lengths: Varies by lender

- Time in Business Required: Varies, generally flexible

- Minimum Annual Business Revenue: Varies, often lower than competitors

- Minimum Personal Credit Score: Flexible, lower scores considered

Wells Fargo:

- Credit Limits: Up to $500,000

- Interest Rates: Competitive, based on business creditworthiness

- Term Lengths: Up to 5 years

- Time in Business Required: Minimum 2 years

- Minimum Annual Business Revenue: Typically higher, varies

- Minimum Personal Credit Score: 680

Each of these lenders offers unique benefits that can suit various business needs, from quick cash flow solutions to larger, long-term investments.

American Express Business Line of Credit Review Summary

The American Express Business Line of Credit is a robust financing solution that caters predominantly to established businesses with solid financial foundations. This line of credit offers the flexibility to withdraw funds as needed up to a set limit, making it an excellent tool for managing cash flow and addressing unforeseen expenses. Interest rates are competitive, especially for businesses with strong credit histories, and the ability to only pay interest on the amount utilized adds to its efficiency. Additionally, the seamless integration with American Express's extensive business tools enables comprehensive financial management from a single platform. However, the product's higher qualification requirements and associated fees might deter smaller or newer businesses from applying.

Key Review Points:

- Financial Flexibility: High credit limits and the ability to draw funds as needed provide significant financial agility.

- Cost-Effective Interest Rates: Attractive rates for those with good credit, charging interest only on the amount drawn.

- Seamless Integration: Integrates with American Express’s suite of business services for an all-in-one financial management experience.

- High Entry Threshold: Demanding credit standards and fees may not be feasible for smaller or less established businesses.

- Dedicated Support: Excellent customer service with access to personalized assistance and online resources.

Conclusion

From personal experience, the American Express Business Blueprint™, formerly known as Kabbage, stands out for its reliability and strategic flexibility it offers, making it a valuable asset for managing both day-to-day expenses and larger financial undertakings.

This line of credit, with the prominent American Express® logo as its marquee, is a boon for blueprint business lines and established companies, enabling them to investopedia their financial trajectories with more confidence. However, it's noteworthy that the ascent to financial robustness using this tool may be more challenging for startup business lines due to accessibility hurdles.

Those who qualify will find it a powerful tool for financial management, underscored by American Express's strong customer support and integrated business solutions. As an account rep might advise, further solidifying the desirability of this financial instrument is the weight of editorial team endorsements from outlets such as Bankrate, which base their reviews on multiple data points and a rigorous methodology.

With continuous updates and disclosures about lender ratings and terms, it's clear that the editorial content is held to high journalism standards to ensure that readers and potential advertisers are well-informed. Compensations such as those detailed on the lender's disclosure notably do not influence the objectivity of these reviews. This line of credit is especially recommended for businesses looking to scale operations while maintaining a handle on their financial health.

Frequently Asked Questions

Does American Express run a hard pull or soft pull on credit?

When applying for an American Express Business Line of Credit, American Express typically conducts a hard pull on your credit report. This hard inquiry can temporarily affect your credit score and will appear on your credit report, as it indicates that you have actively applied for credit. The key points are Hard Pull Impact: A hard pull might slightly lower your credit score for a short period, and Visibility: Such inquiries are visible to other creditors and can influence future credit evaluations.

What is American Express Blueprint?

American Express Blueprint is a financial management platform tailored specifically for businesses, offering a suite of tools designed to enhance spending oversight, borrowing efficiency, and savings strategies. This platform integrates seamlessly with other American Express services, providing businesses with detailed analytics and customized financial planning capabilities to foster growth and financial stability.

How fast can I fund my business with American Express Business Line of Credit

Funds from the American Express (Amex) Business Line of Credit are generally available within one business day following approval, offering swift assistance to enhance your revenue Amex. However, the actual time to receive the funds can vary depending on the borrower's financial institution and may extend up to three business days. For entrepreneurs seeking a startup business loan, it's worth noting that Amex also requires you to have started your business at least a year ago and have an average monthly revenue of at least $3,000. Choosing your American Express Business Checking account for the deposit can result in instant availability of funds, although the posting time might be longer.

Does American Express Business Line of Credit Require Collateral?

The American Express Business Line of Credit does not typically require collateral, as it is usually an unsecured line of credit. This lending option empowers businesses by providing access to funds without the necessity to pledge specific assets as security. Thus, it is one of the more accessible financial solutions for companies looking to expand or manage cash flow efficiently.